US stocks ended Tuesday mixed as tech weakness dragged the Nasdaq lower, while the Dow hovered flat and the S&P 500 slipped modestly. Investors weighed fresh retail earnings against tariff concerns and the Federal Reserve’s upcoming policy signals.

Major Index Moves

- Dow Jones Industrial Average (DJI): 44,863.70 (–0.11%)

- S&P 500 (GSPC): –0.68%

- Nasdaq Composite (IXIC): –1.33%

- Futures: S&P 500 –0.53%, Nasdaq –1.33%, Dow –0.01%

Sector Highlights

Retail: Signs of Life

- Home Depot (HD): Shares rose after reporting a return to same-store sales growth despite missing estimates. Analysts pointed to signs of stabilization in U.S. housing as a driver.

- What’s Next: Target (TGT) reports Wednesday, Walmart (WMT) Thursday. Together, these will offer a clearer picture of consumer resilience under Trump’s tariffs.

Tech: Pressure Mounts

- Palantir (PLTR): –8.85%, leading tech losses.

- AMD (AMD): –4% on sector-wide weakness.

- Intel (INTC): +7% after SoftBank unveiled a $2B stake, boosting hopes for Intel’s turnaround amid speculation of a potential U.S. government investment.

Why the Sell-Off Happened

1. Earnings & Valuations

Mega-cap tech stocks like Apple and Microsoft, trading at ~30x earnings, are priced for perfection. Any sign of slowing growth or missed estimates sparks profit-taking, especially when markets sit near record highs.

2. Tariffs & Policy Jitters

Trump’s tariff push keeps global supply chains on edge. Tech, with its heavy exposure to cross-border components, often absorbs the brunt of that volatility.

3. Macro Data Meets Fed Uncertainty

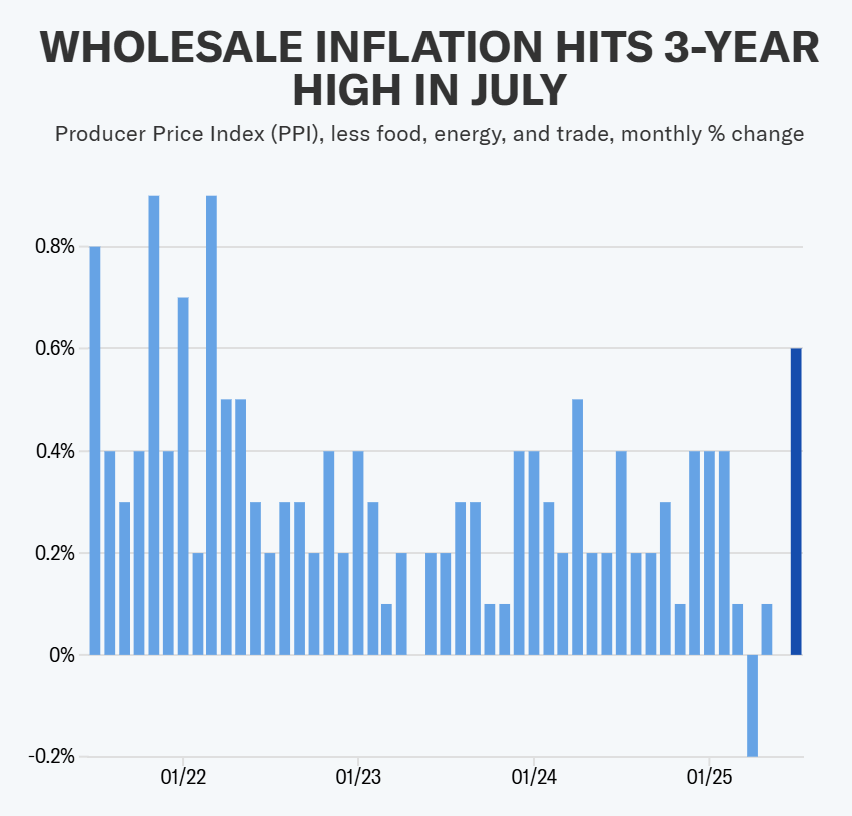

Weak jobs growth (worst in 3 years) versus surging PPI inflation (fastest in 2 years) gives the Fed a headache. Traders are waiting for Powell’s Jackson Hole speech, and the lack of clarity is fueling caution.

Economists warn the Fed is caught between two mandates: a softening labour market arguing for cuts, and broad-based services inflation (like healthcare, travel, wages) pushing the case for restraint. Some even say the Fed should be raising, not cutting, rates.

4. Market Rotation

Investors rotated into small caps and cyclical names (industrials, financials, consumer discretionary), betting they’ll benefit more from lower rates than already-expensive large-cap tech.

5. AI & Sector-Specific Pullback

High-flyers like Nvidia and Palantir have led the rally, but fears of an AI bubble and stretched valuations triggered sharp reversals.

6. Geopolitical Overhang

Ukraine diplomacy and Trump’s hints of talks with Putin injected another layer of uncertainty. Defense and energy stocks traded choppy, while broader markets treaded cautiously.

Looking Ahead

Markets are bracing for Fed Chair Jerome Powell’s speech at Jackson Hole (Aug 21–23). Futures currently price in an 83% chance of a 25bps cut in September, but uncertainty remains as the Fed navigates weak labor data vs. rising inflation.

Meanwhile, geopolitics remains in play: Trump signaled more Ukraine talks with Putin and Zelenskyy, keeping defense and energy traders on edge.

Tuesday’s action showed a classic rotation day — retail finding its footing, Intel’s surprise bounce, but tech-heavy Nasdaq weighed down by valuations, tariffs, and Fed uncertainty.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Zelenskyy–Trump Summit: Key takeaways from Diplomatic Optics to Defense Deals

Zelensky–Trump Meetings: How 2025 Shaped Energy & Defense Stocks