Markets are waking up cautious this Thursday, with all eyes fixed firmly on Jackson Hole. Federal Reserve Chair Jerome Powell is due to deliver his final speech at the annual symposium tomorrow, but investors already got a taste of the Fed’s thinking from the July meeting minutes released Wednesday.

The minutes revealed a central bank wrestling with two risks at once: a labor market losing steam and tariff-driven inflation that refuses to fade. Add to that fresh political pressure from President Trump, and the stage is set for one of Powell’s most consequential appearances yet.

Powell’s Last Jackson Hole Speech Ahead

Friday marks Jerome Powell’s final appearance as Fed chair at Jackson Hole. Investors expect him to set the tone not just for the coming months, but also for how his tenure will be remembered.

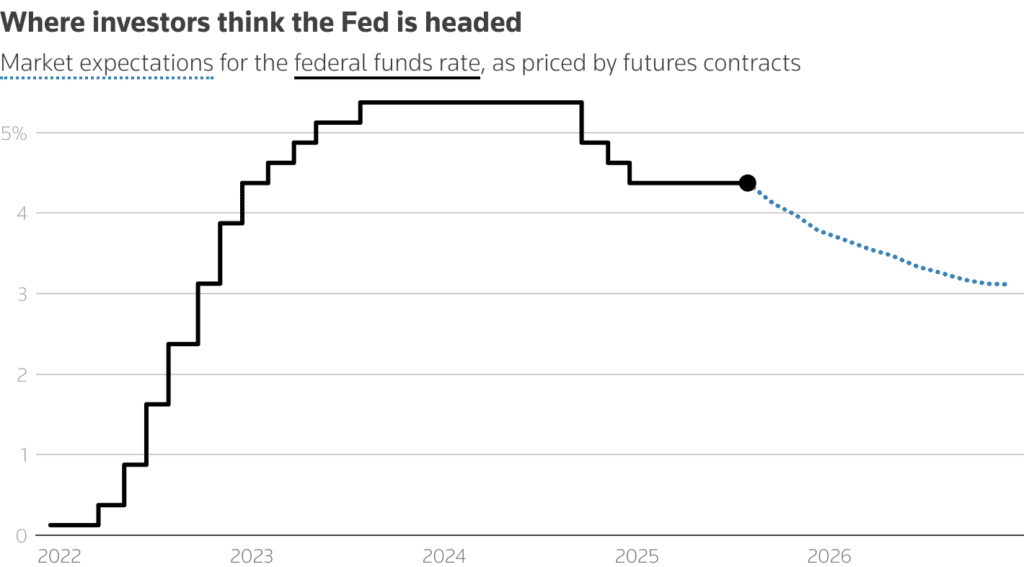

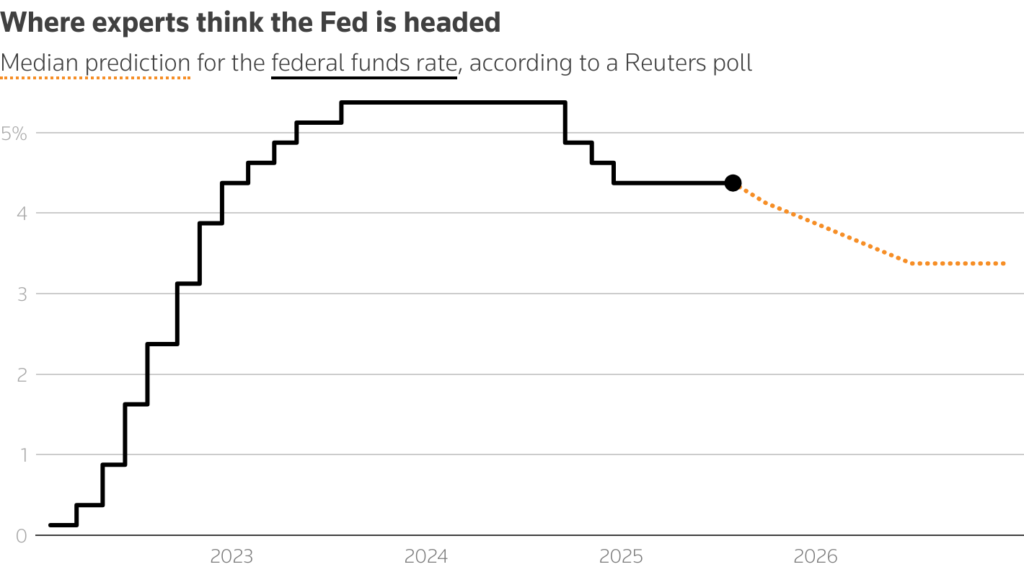

Markets are pricing about an 80% chance of a September rate cut, though that’s down slightly from earlier in the week after Fed minutes showed only two dissenters (Bowman and Waller) were pushing for cuts last month.

The inflation picture remains messy: consumer prices have shown little tariff impact so far, but producer prices are climbing — hinting that costs could soon filter down to consumers.

Trump Pressure on the Fed

President Trump has been relentless in his attacks on the Fed. His latest demand: the resignation of Governor Lisa Cook, following mortgage-related allegations.

If successful, Trump would gain another board seat, adding to his influence alongside his appointees Bowman, Waller, and Miran (nominated to replace Kugler). That could tilt the Fed more firmly toward Trump’s call for lower rates.

Markets remember Trump’s earlier threats to fire Powell, which rattled the dollar. But for now, the currency has held steady despite the political noise.

Market Snapshot

Asia: Tech stocks steadied, with the MSCI Asia Pacific Tech Index +0.1%. TSMC and Samsung led gains after Nasdaq futures found footing overnight.

Currencies: The dollar edged higher by 0.1%, while yen and euro traded flat.

Commodities: Oil eased ~0.8% on speculation that a ceasefire could free up Russian supply.

Wall Street: Tech selloff was largely shaken off; Japan’s Advantest, a chip-testing giant, led gains in Tokyo.

U.S. Futures: Little changed ahead of data.

US Markets: Tech Still on the Back Foot

The second straight day of tech selling saw the Magnificent Seven lose ground:

- $AAPL -2%, $AMZN -1.8%, $GOOGL -1.1%, $MSFT -0.8%.

- $NVDA slipped just -0.1% after Tuesday’s sharp drop. $MU -4%, $AVGO -1.3%.

The pullback comes after:

- An MIT report showed 95% of companies see no ROI on AI investments. ( More about: MIT study: 95% GenAI projects fail to show returns)

- OpenAI’s Sam Altman bluntly called the sector a bubble.

Still, Wedbush’s Dan Ives says the “AI bull cycle” is intact for another 2–3 years, led by Nvidia and Big Tech spending.

What to Watch Today

- Jackson Hole symposium opens

- U.S. data: Weekly jobless claims, July existing home sales, Philly Fed business index

- Europe: Flash PMIs for euro zone, Germany, France, UK

- Earnings: Walmart ($WMT) results — a key health check on U.S. consumers

- Pre-Market: Walmart ($WMT), Canadian Solar ($CSIQ), Bilibili ($BILI), SelectQuote ($SLQT)

- After Hours: Zoom ($ZM), Workday ($WDAY), Intuit ($INTU), Ross Stores ($ROST)

The Fed’s July minutes underscored its inflation-first stance, even as jobs weaken. Trump’s attacks on the Fed and calls for resignations have added fuel to investor unease. Global markets are steadying after a tech wobble, but with Powell’s last Jackson Hole speech less than 24 hours away, nerves are high.

Friday may decide whether the September cut is a done deal — or if the Fed holds its line longer than markets expect.