Michael Burry, the investor made famous by “The Big Short”, has opened a new front in the debate over artificial intelligence, accusing Big Tech companies of inflating their AI-era profits by quietly extending the depreciation life of their data-centre hardware.

The comments come just days after Burry shut down Scion Asset Management and revealed major bearish bets against Nvidia and Palantir. Now, with a single viral post on X, he has pushed the accounting side of the AI boom into the spotlight.

Check this: Michael Burry Shuts Down Scion Asset Management — Hints at New Project Coming November 25

A Question That Cuts to the Heart of AI Economics

Burry’s claim is straightforward:

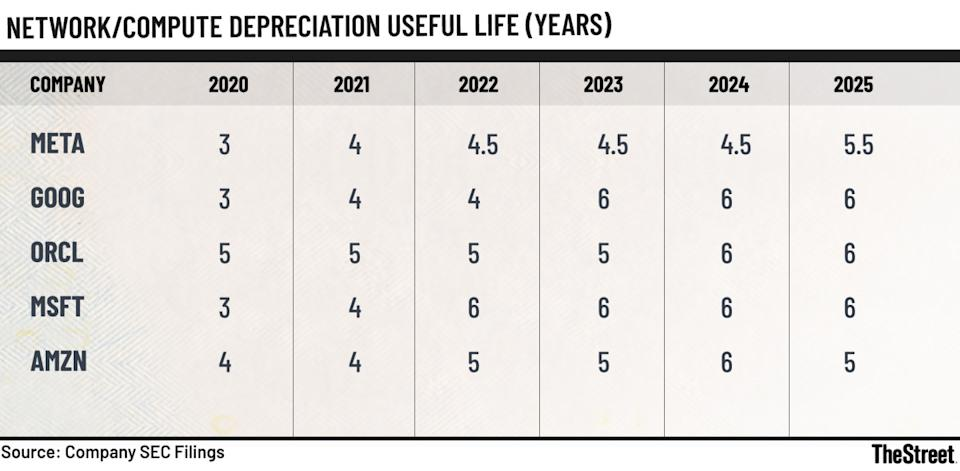

Big Tech companies — including Meta, Alphabet, Microsoft and Oracle — have been stretching the “useful life” of their servers and GPUs from around four years to five or six years.

The longer the life, the lower the annual depreciation charge. Lower depreciation means higher reported earnings, even if the underlying hardware is losing value much faster.

In Burry’s words, this practice is:

“One of the more common frauds of the modern era.”

He argues that with Nvidia releasing new chips every 12–18 months, hardware should be depreciated faster, not slower. Extending the schedule, he says, artificially boosts profits at a time when companies are spending hundreds of billions on AI infrastructure.

The Numbers Behind the Accusation

Over the past two years, Big Tech has dramatically accelerated its AI spending. Combined capital expenditures for Meta, Alphabet, Microsoft and Amazon are expected to reach $460 billion within the next 12 months. Almost all of it goes into GPU clusters, servers, networking equipment and cooling systems.

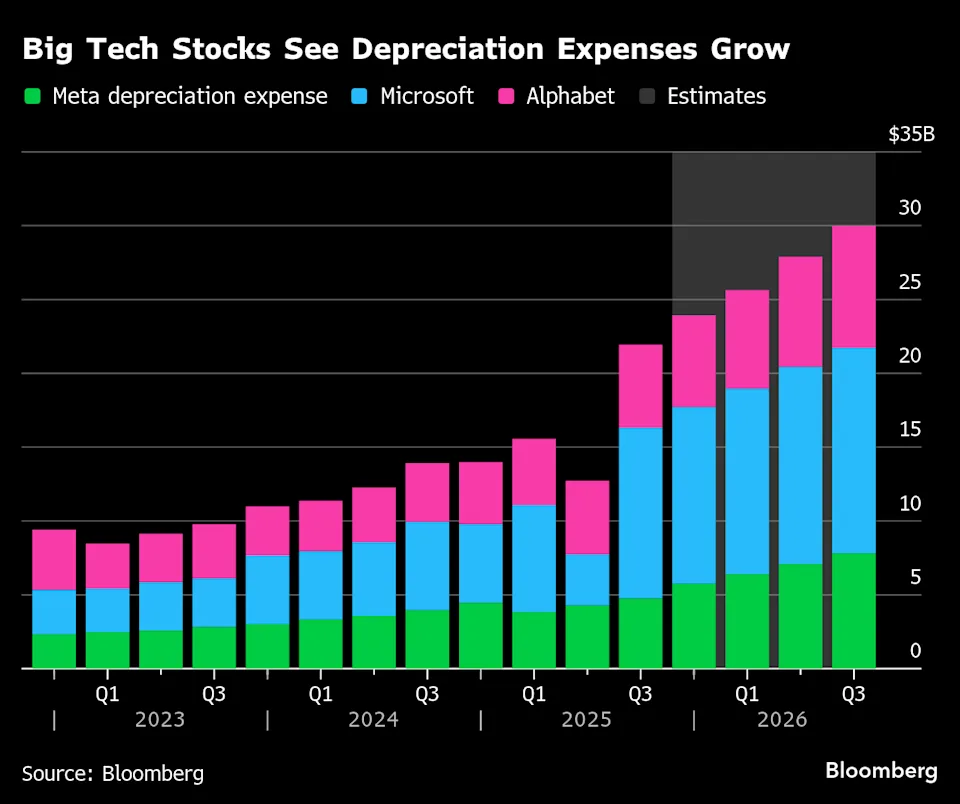

Even with stretched depreciation, total depreciation costs have nearly doubled:

- At the end of 2023, Big Tech recorded about $10 billion in depreciation per quarter.

- By late 2025, that figure is closer to $22 billion.

- Analysts expect it to reach $30 billion by next year.

Without the accounting changes, those expenses would be even higher — and reported earnings would be noticeably lower.

Burry estimates that by 2028:

- Oracle’s earnings may be overstated by almost 27%,

- Meta’s by more than 20%.

He promised to release a full breakdown on November 25, turning his remarks into one of the most anticipated disclosures in the AI investment world.

A Sensitive Moment for the AI Trade

The timing of Burry’s criticism amplifies its impact. The AI trade has already entered a more cautious phase. Investors are moving from AI hype to AI proof, demanding real returns on the massive infrastructure spending.

Meta’s stock, for example, is up only 4% this year — far below the Nasdaq 100 — and has fallen sharply in the second half of 2025. Alphabet, on the other hand, has surged 47%. Microsoft remains steady, while Nvidia continues to face skepticism despite dominating the GPU market.

Burry’s comments now add a new layer of doubt: If AI hardware becomes obsolete quickly and depreciation is understated, then AI earnings may be flattered, margins may be thinner, and valuations may look less justified.

Experts Are Split

Some analysts argue that Burry is simply pointing out what everyone knows:

depreciation schedules are estimates, and companies adjust them as technology evolves.

They say modern cooling systems, better utilization strategies and improved software allow hardware to remain productive for longer.

Others, however, warn that AI chips may actually wear out faster given their extreme workloads. Studies from Meta and comments from industry insiders suggest GPUs have meaningful failure rates after three years — far below the six-year useful life some companies now report.

The truth may lie somewhere in the middle — but the debate is now out in the open.

What Happens Next

Whether Burry is right or wrong, his accusation forces a deeper question across the market:

Are Big Tech’s AI profits real, or do they simply look better because of accounting adjustments?

If depreciation is too generous, then:

- margins are overstated,

- earnings are inflated,

- and investors may be misreading the true cost of the AI revolution.

If depreciation is justified, then Big Tech is simply becoming more efficient — and the massive AI spending will pay off over time. With Burry promising more details later this month, the entire sector is watching.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.