Markets found a lifeline Wednesday as soft labor data revived confidence in a September Federal Reserve rate cut, sparking a bond rally and lifting big tech stocks, even as broader economic worries weighed on sentiment.

Labor Market Weakness Shifts Fed Outlook

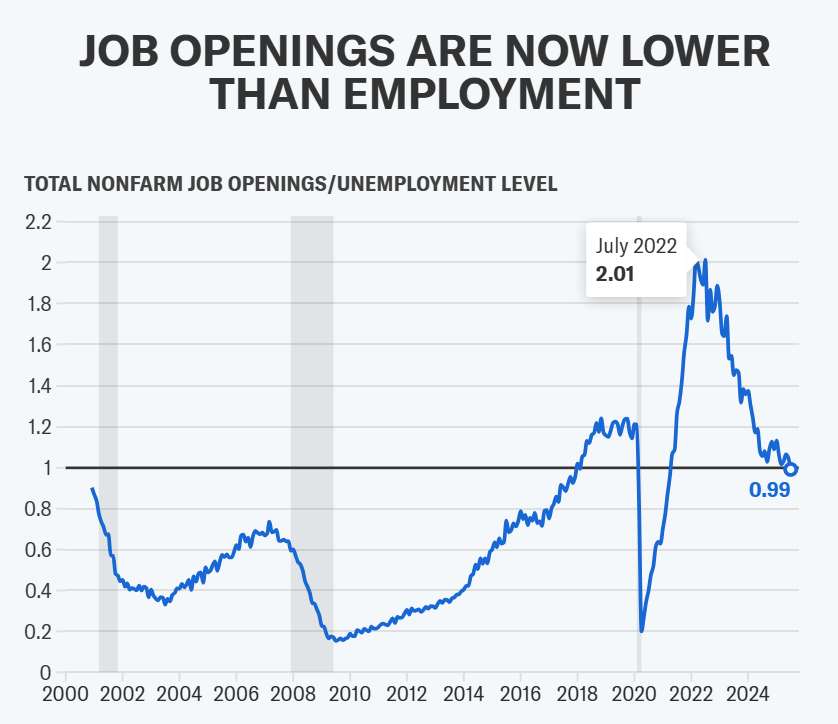

The JOLTS report showed job openings fell to 7.18 million in July, the lowest in nearly a year and below expectations of 7.38 million. For the first time since April 2021, there are now more unemployed workers than job vacancies — a ratio of 0.99.

- Traders now price a 95% chance of a Fed rate cut in September, up from 92% earlier in the day (CME FedWatch).

- While some economists warn the data signals cooling demand, others argue this is closer to a “soft landing” scenario rather than an outright recession.

- Bank of America’s Aditya Bhave noted labour force participation has weakened due to ageing demographics and restrictive immigration policies, balancing out falling demand.

The critical August payrolls report Friday remains the make-or-break data point for the Fed’s September decision.

Bond Market Surge

Treasuries rebounded sharply:

- 30-year yields eased from near 5% highs.

- Two-year yields dropped as traders piled into bets of at least two Fed cuts in 2025.

The move reflects investor positioning ahead of a potential policy pivot after months of sticky inflation data.

Stocks: Tech vs. Broader Market

The Nasdaq Composite rose 0.7%, fueled by Alphabet ($GOOGL) which surged 8% after a court ruled it could keep Chrome, avoiding a forced divestiture.

- Apple ($AAPL) also jumped 3% as it can continue preloading Google Search, preserving a lucrative revenue stream.

- The S&P 500 edged up 0.1%, while the Dow Jones fell 0.6% (-291 points) as bank and energy shares sank on economic worries.

- Alphabet was among 10 S&P 500 stocks hitting new all-time highs.

Market strategist Mark Mahaney called the ruling a “clearing event” for GOOGL, letting investors refocus on fundamentals.

Small-Cap Flows Signal Confidence

Bank of America reported $1.5 billion of inflows into small-cap stocks last week — the second-largest since 2008.

- Clients bought both small-cap ETFs and single names, betting they will benefit disproportionately from lower rates.

- Analysts expect small caps ($IWM) to outperform in the near term if the Fed eases.

Seasonal Risks: September’s Shadow

History remains a headwind. Since 1950, September has been the worst month for the S&P 500, averaging a 0.7% decline.

- Wells Fargo’s Scott Wren warned of higher volatility as political uncertainty, tariffs, and slowing growth converge.

- Trump’s tariffs faced a setback last week when a court ruled many were illegal, though they remain in place pending appeal to the Supreme Court. Refunds for businesses could reach billions.

Markets are caught between relief and caution. Weak job openings have cemented rate cut expectations, sparking rallies in bonds and mega-cap tech. But with Friday’s payrolls report looming and September’s historical weakness hanging over equities, volatility looks set to rise.

The balance of power for markets now lies squarely in labor data — and in whether the Fed follows through on its September pivot.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)