Wall Street, Asia, and Europe all saw record or near-record highs, but beneath the rally, investors are laser-focused on the Fed’s next move, France’s political crisis, and Trump’s escalating tariff diplomacy.

US: Jobs shock keeps Fed in the spotlight

Wall Street closed at fresh records on Tuesday, with the S&P 500, Dow, and Nasdaq all notching new highs. Gains were driven by big tech, even as market breadth weakened — the equal-weight S&P 500 actually finished down 0.3%.

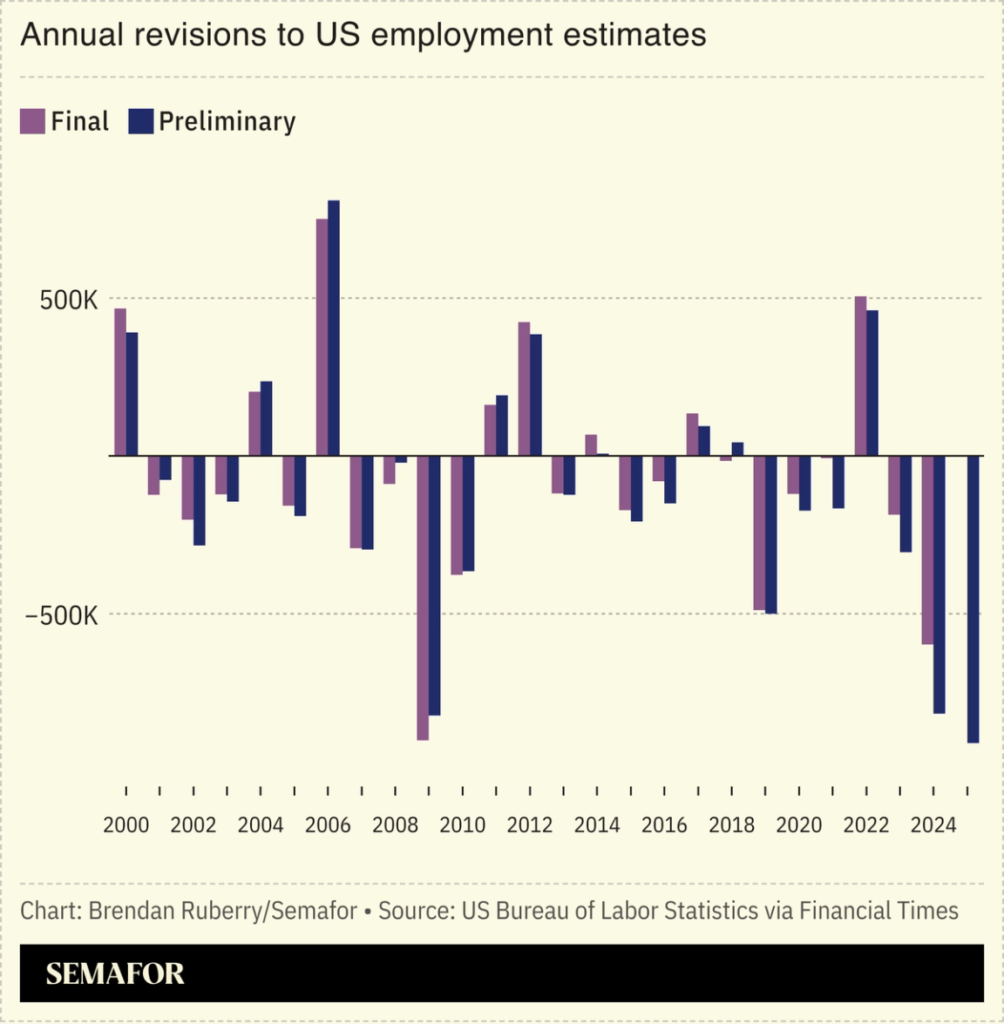

The resilience came despite a historic revision to payroll data, which showed 911,000 fewer jobs were created in the year through March than initially reported. This confirmed that the labor market has been slowing for months, intensifying pressure on the Federal Reserve to cut rates at its September 16–17 meeting.

Markets are fully priced for a 25 bps cut next week, with roughly 8% odds on a 50 bps move. Futures imply 66 bps of easing by year-end. But Jamie Dimon (JPMorgan CEO) warned. (More about: Wall Street Holds Highs Despite Historic Job Revision, But JPMorgan Warns)

Europe: France now priced as risky as Italy

In Europe, the STOXX 600 was flat while France’s CAC 40 eked out gains. But political risk looms large: Prime Minister François Bayrou lost a confidence vote and resigned, forcing President Emmanuel Macron to appoint his fifth PM in two years.

Bond markets have already punished France. 10-year OAT yields surged to ~3.49%, nearly matching Italy’s 3.51%, making French debt the second-riskiest in the eurozone by yield. Investors are bracing for Fitch’s rating review on Friday, with a downgrade possible.

More about: France’s Government Collapses — What Moved in Markets and What’s Next

Domestic stocks like BNP Paribas and Societe Generale have slid, while unions are planning nationwide protests against austerity on Sept. 10 and Sept. 18. Markets see little chance of snap elections but expect prolonged gridlock, complicating fiscal repair.

Geopolitics: Trump flexes tariffs, Modi signals optimism

On the geopolitical stage, President Donald Trump sharpened his trade weapons. He urged the EU to impose tariffs of up to 100% on China and India to pressure Putin over Ukraine, a major escalation that could fracture global supply chains.

At the same time, Trump said he expects a “successful conclusion” to ongoing US–India trade talks, highlighting negotiations on energy and agriculture. Prime Minister Narendra Modi echoed the optimism, calling the US and India “close friends and natural partners.” Both leaders stressed the talks could unlock “limitless potential,” even as disputes over Russian oil and tech market access remain unresolved.

The contrast reflects Washington’s dual track: seeking cooperation with India while threatening tariffs to push it away from Russian energy dependence.

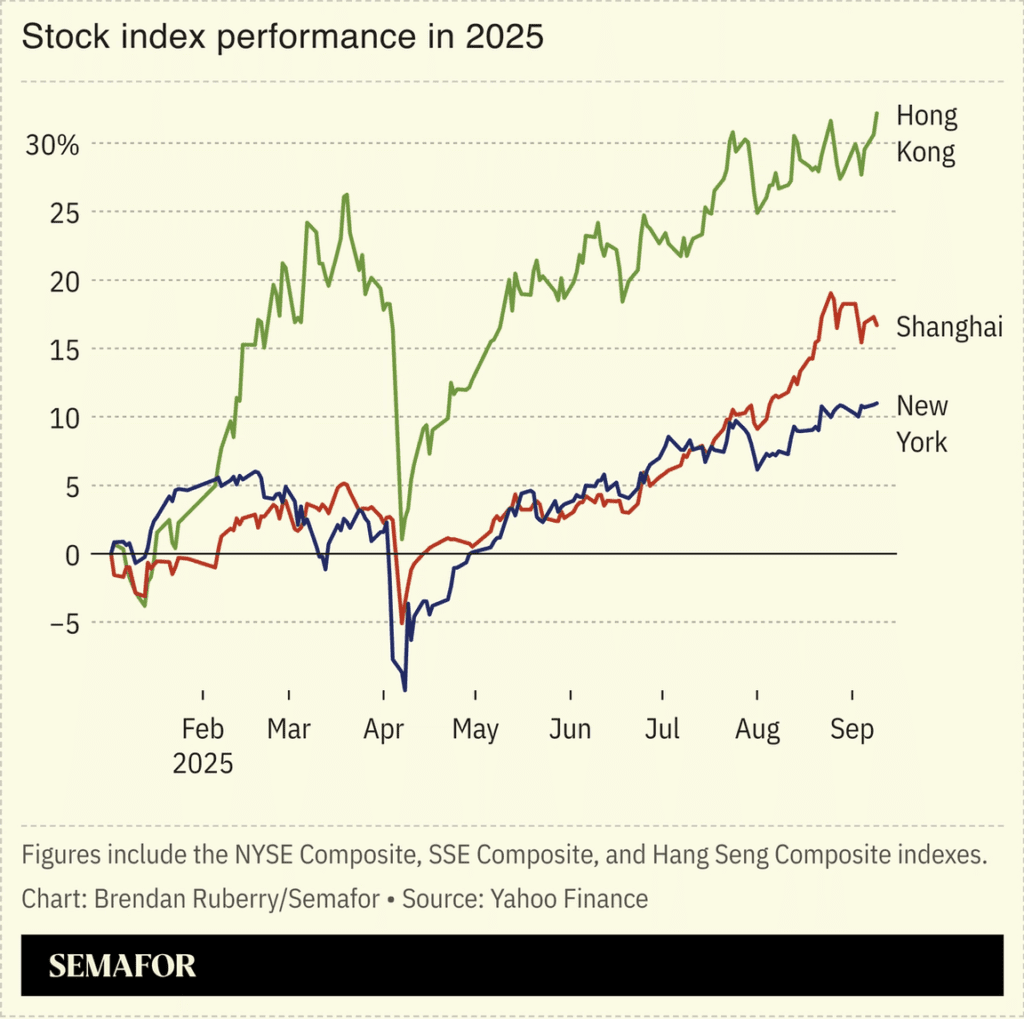

Asia: Record highs, cautious tone

Asian markets mirrored Wall Street’s strength.

- Japan’s Nikkei rose 0.8%, back near record territory.

- Taiwan’s TWII hit an all-time peak, +1.5%.

- South Korea’s KOSPI gained 1.7%.

- Hong Kong’s Hang Seng added 1.3%.

Investors are betting the Fed’s cuts will support global liquidity, but inflation surprises remain the risk. Geopolitical tension also lingers after Israel struck Hamas leaders in Doha, prompting Poland to shoot down Russian drones near its airspace — NATO’s closest encounter yet with the war spillover.

Commodities and currencies

Gold steadied after a record run, holding above $3,620/oz, as rate cut bets keep demand strong.

Oil extended gains, with Brent at $67.13 and WTI at $63.34, after Israel’s Doha strike raised Middle East supply concerns.

Bitcoin held firm above $111,000, with traders watching whether Fed easing could fuel another crypto surge.

The dollar index was little changed, with the euro near $1.1715.

How We Started Today

Markets opened steady with a neutral sentiment. Wall Street is treading water near record highs as traders balance cooling labor data with looming inflation prints.

What to Watch Today

Key Data: August PPI (8:30 AM ET) — today’s big test for Fed cut bets. A hot print could revive stagflation fears, while softer numbers would lock in easing.

Microsoft speaks at Goldman Sachs — investors watching for AI and cloud demand signals.

Earnings highlights: Chewy ($CHWY), Amber International ($AMBR), Vince Holding ($VNCE), Lesaka Technologies ($LSAK).

Other data: Wholesale Inventories, Crude Oil Inventories, 10-Year Auction, Atlanta Fed GDPNow, Federal Budget Balance.

Today’s Calendar (ET/UK time):

- 08:30 / 13:30 — PPI (Aug)

- 10:30 / 15:30 — Crude Oil Inventories

- 13:00 / 18:00 — 10-Year Note Auction; Atlanta Fed GDPNow

- 14:00 / 19:00 — Federal Budget Balance

- Pre-Market: Chewy ($CHWY), Amber International ($AMBR)

- After-Market: Vince Holding ($VNCE), Lesaka Technologies ($LSAK)

The rally is pausing, but all eyes are on inflation. If PPI confirms cooling, the Fed cut narrative stays intact; if not, markets could wobble. Until then, sentiment remains neutral, with traders hedging between optimism and caution.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

France’s Government Collapses — What Moved in Markets and What’s Next

The Big Question: Are Crypto ETFs About to Explode?

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Bitcoin ETFs Surge on Trump Election Prospects, Market Braces for Volatility