Margin borrowing is surging to record highs, but it may be a signal about brokers, not stocks.

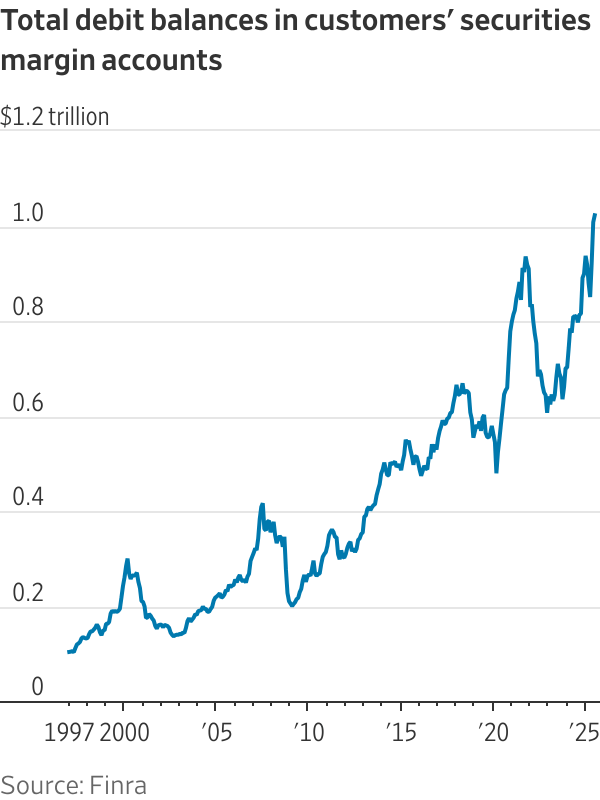

Margin debt, the money investors borrow against their brokerage accounts to buy more stocks or post collateral, has topped $1 trillion for the first time ever, according to fresh July data from FINRA. The milestone is sparking debate on whether Wall Street is flirting with another warning sign for the S&P 500, or if the surge is simply a byproduct of rising equity markets.

What is margin debt?

Margin debt comes from borrowing against your securities in a brokerage account. Investors use it in two main ways:

- To leverage long bets and buy more shares than they could with cash alone.

- To short stocks, since short-sellers must post collateral that scales up as share prices rise.

The attraction is obvious: borrowing allows investors to amplify returns when markets go up. But the risk is just as real: if stocks fall, lenders issue margin calls, forcing investors to sell into weakness — often accelerating downturns.

Why margin debt matters

Sharp rises in margin borrowing have historically preceded painful market corrections, as forced unwinds magnify sell-offs. Yet analysts warn against reading today’s $1 trillion figure too literally. Because stock prices themselves are rising, margin balances can climb automatically as short-sellers post more collateral, making margin debt just as much a reflection of market levels as of investor risk-taking.

“On its own, record-high margin debt is no more predictive than the S&P 500’s price,” analysts note. Still, if retail borrowing were rising disproportionately, it could be a clearer sign of exuberance. Unfortunately, FINRA doesn’t break down who is doing the borrowing, hedge funds, institutions, or individuals.

Winners in the margin boom

Even if margin balances aren’t a crystal ball for the next correction, they do reveal a clear beneficiary: brokerages.

- Charles Schwab and Interactive Brokers both saw margin-loan books jump over 15% year-on-year in Q2.

- Robinhood’s margin lending surged 90% as it rolled out new pricing aimed at sophisticated traders.

- These loans, combined with trading fees, are powering a boom in net interest income at brokerages — even with rates lower than a year ago.

Shares of these firms are responding: Robinhood is up 400% in the past year, Interactive Brokers +100%, Schwab +45%, and Wall Street titans Morgan Stanley and Goldman Sachs around +40%. For comparison, the S&P 500 is up 13%.

The double-edged sword

Margin is rocket fuel on the way up, but it cuts both ways. If markets fall, collateral requirements shrink, investors repay loans, and margin balances quickly flip from asset to liability. That means brokerages’ interest income, asset-based fees, and trading volumes could collapse just as quickly as they soared. Their stocks, supercharged on the way up, often fall harder on the way down.

Margin debt hitting $1 trillion is less a countdown to a crash than a reminder of how leverage magnifies risk. It’s also a signal that brokerages, not the S&P 500, are the real barometer here: their earnings now swing in rhythm with the rise and fall of margin balances.

For investors, that means margin levels may not tell you when the market will turn, but they do reveal who might feel the most pain when it does.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana