As we approach the week of February 10–16, 2025, several major financial events are set to influence the stock market, interest rates, and investor sentiment. These key developments could increase volatility, providing opportunities and risks for traders and long-term investors.

1. U.S. Consumer Price Index (CPI) – February 12

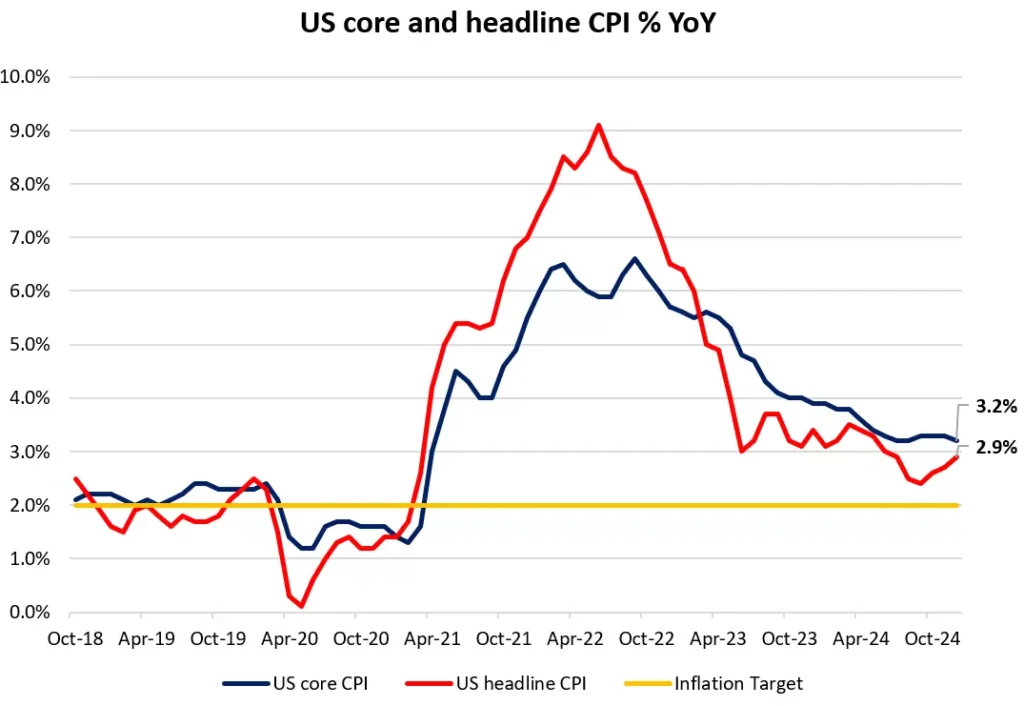

- The Consumer Price Index (CPI) report from the U.S. Bureau of Labor Statistics will be released on February 12.

- Investors will closely watch inflation trends, as the Federal Reserve’s interest rate decisions heavily depend on these figures.

- Market impact:

- Higher-than-expected inflation → Could trigger a sell-off, as it may delay rate cuts.

- Lower-than-expected inflation → Could boost stocks, as it strengthens the case for monetary easing.

2. Corporate Earnings Reports

- Over 120 S&P 500 companies are set to report Q4 2024 earnings, including:

- BP, Lyft, Barratt Developments, and PepsiCo.

- Market impact:

- Stronger-than-expected earnings → Could drive a broad market rally.

- Weak earnings or guidance cuts → May lead to sector-specific downturns.

3. U.S. Retail Sales Data – February 14

- The U.S. Census Bureau will release January retail sales data on February 14.

- This report measures consumer spending trends, a key driver of the U.S. economy.

- Market impact:

- Strong retail sales → Could signal a resilient economy and support stock prices.

- Weak consumer spending → May raise recession fears, leading to a potential market pullback.

4. Central Bank Decisions (BOE & RBI)

- Both the Bank of England (BOE) and Reserve Bank of India (RBI) are expected to announce interest rate decisions.

- Market impact:

- If these central banks signal further tightening, it could lead to global bond yield movements that impact equity valuations.

- If they hint at easing, risk assets, particularly emerging markets, could benefit.

5. Trump to Announce Reciprocal Tariffs – Could a Market Dip Be Coming?

- U.S. President Donald Trump is expected to announce a reciprocal tariff policy, which could target Chinese and European imports. (Read More)

- Market impact:

- Tech and auto stocks with exposure to China and Europe could see selling pressure.

- Industrials and commodities may benefit if protectionist policies lead to higher domestic production demand.

6. Geopolitical Developments & Market Sentiment

- Global political and trade tensions remain a key risk factor.

- Any new tariffs, trade policies, or economic sanctions announced during the week could lead to sector-wide volatility, especially in technology, manufacturing, and energy stocks.

Conclusion: Volatility Ahead?

- Next week’s market movement will largely depend on inflation data (CPI), corporate earnings, and political developments.

- Traders should be prepared for short-term fluctuations, while long-term investors should assess whether any pullbacks present buying opportunities.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related articles:

Earnings Calendar for This Week: Stocks to Watch and Forecast

Bullish Momentum vs. Financial Reality in Palantir

Here Are 10 Most Polarizing Stocks in Market Right Now & Why Critics Might Be Wrong

China tech stocks enter bull market: Here’s why and what to expect

After quietly hit a record high, Gold is telling us something

Trumpiverse: Ranking Trump’s Inner Circle

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Here is why stock market will be HIGHLY tradable: More volatility is coming

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Trump’s Media Group Files for Bitcoin ETF: A Game-Changer for DJT?

Stock Market on Edge: Mixed US Jobs Report Sparks Uncertainty Over Fed’s Next Move

![Key Events to Watch in [Week] & Their Market Impact](https://finblog.com/wp-content/uploads/2025/02/DALLE-2025-02-08-220750-A-dynamic-and-professional-looking-featured-image-for-a-financial-market-report-titled-Key-Events-to-Watch-in-Week-Their-Market-Impact-The-imag-1024x715.webp)