A regulated stablecoins boom could transform global finance, fueling US Treasury demand, boosting dollar dominance, and raising new risks for banks and central banks.

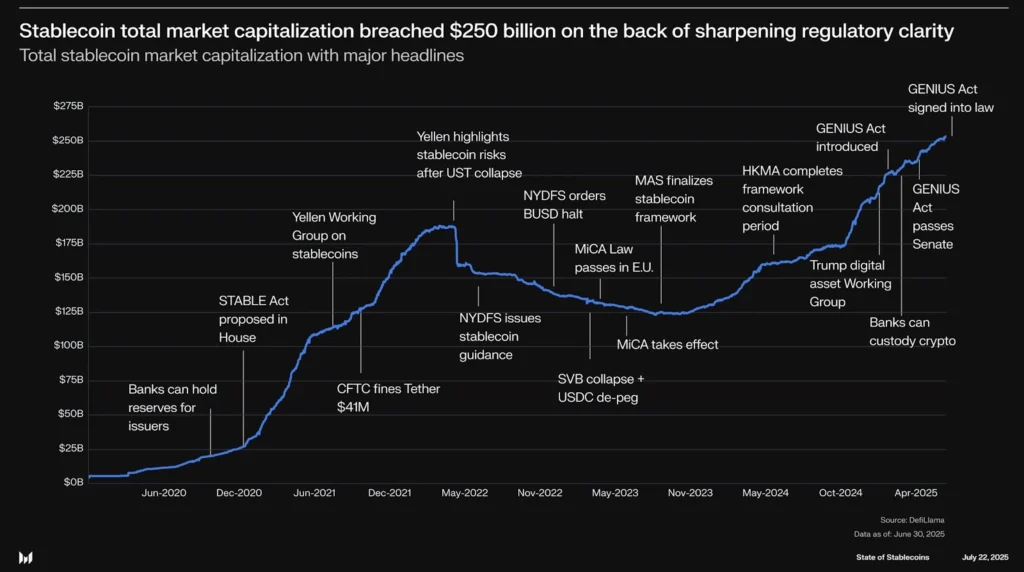

The global stablecoin market — once a niche corner of crypto — is now moving into the heart of traditional finance. With the US GENIUS Act signed into law in July, Wall Street, policymakers, and foreign central banks are recalibrating around what could become a multi-trillion-dollar asset class. At stake: the structure of the US Treasury market, the dominance of the dollar, and the future of global payments.

Stablecoins Enter the Big Leagues

Stablecoins — digital tokens designed to hold a fixed value, usually pegged to the US dollar — have surged past a combined market capitalization of $250 billion in 2025, up more than 20% this year alone. The GENIUS Act, signed in July by President Donald Trump, has provided regulatory clarity by requiring issuers to back tokens with dollars or high-quality liquid assets such as Treasury bills. That rule is transforming stablecoins into de facto buyers of US debt.

Wall Street analysts and policymakers now agree: the stablecoin boom is not only about crypto adoption, it’s about who finances America’s $37 trillion national debt.

Scott Bessent, the US Treasury Secretary, has been blunt: stablecoins are a “win-win-win” — expanding dollar access globally, fueling demand for Treasuries, and reinforcing the dollar’s global dominance.

“Stablecoins will expand dollar access for billions across the globe and lead to a surge in demand for US Treasuries,” Treasury Secretary Scott Bessent said. “It’s a win-win-win for stablecoin users, issuers, and the US government.”

From Bitcoin Hype to Stablecoin Dominance

Bitcoin may have pioneered crypto, but stablecoins have quietly overtaken it in practical use. They are:

- Dollar-linked, without the volatility — attractive for payments and savings.

- Globally accessible — useful for remittances and cross-border commerce.

- Integrated with traditional finance — embedded in DeFi, exchanges, and increasingly corporate treasuries.

Circle’s stock, up 540% since its IPO, underscores investor confidence in stablecoins as the backbone of digital finance. Ripple USD (RUSD) and decentralized options like DAI/USDS are emerging challengers, but regulatory clarity gives USDC and Tether a decisive edge.

Who’s leading the charge

At the center of the boom are two giants:

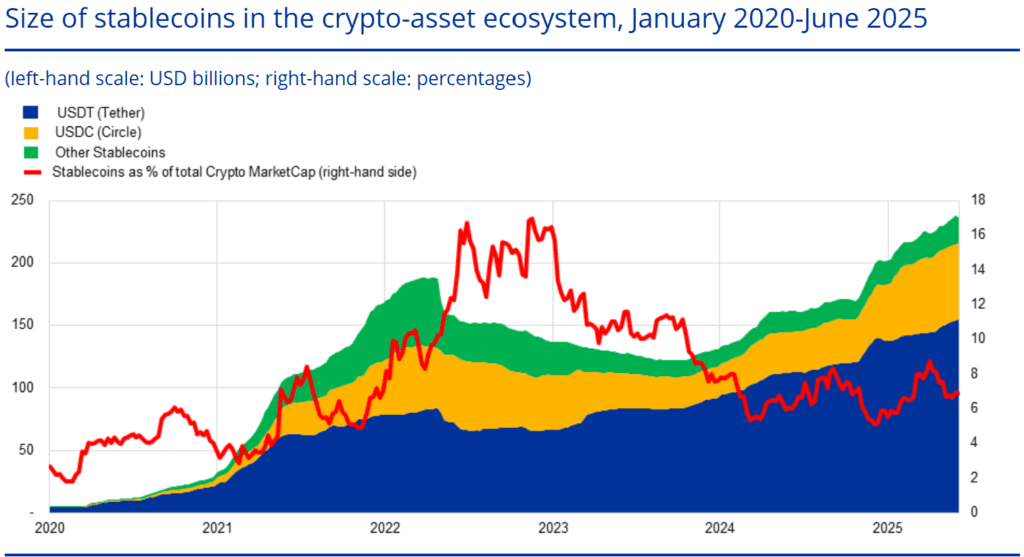

- Tether (USDT), with nearly 60–65% of market share, is heavily used abroad for dollar access and liquidity. But its quarterly reserve reporting and past regulatory fines leave questions under the new GENIUS Act.

- Circle’s USDC, now about 25% of the market, positioned as the compliant alternative. Circle publishes monthly Big Four attestations and has won EU MiCA authorization, giving it a strategic edge with regulators and institutions.

Runners-up include:

- Ripple USD (RUSD), launched in late 2024 with New York DFS approval and integrated into Ripple’s cross-border payments network. Its link to XRP settlement makes it a serious long-term contender.

- DAI/USDS, run by the decentralized Sky DAO, appealing to crypto purists for its censorship resistance. Its overcollateralized design reduces reliance on Treasuries but exposes users to crypto market volatility.

Together, Tether and USDC control over 90% of the global stablecoin market, but challengers are emerging. The GENIUS Act may tilt the balance further toward compliance-first issuers like USDC and RUSD.

Wall Street’s Stablecoin Gold Rush

Goldman Sachs has dubbed this moment the start of a “stablecoin gold rush.” The bank projects 40% annualized growth, with cross-border payments and tokenized cash management as the biggest prize.

- Standard Chartered sees $750B market size by 2026 as the tipping point where stablecoins reshape Treasury issuance and monetary policy.

- Bernstein projects up to $4 trillion in market cap by 2035.

- Ark Invest argues stablecoins could become the largest single source of Treasury demand by 2030, lowering long-term US borrowing costs.

Dollar Dominance Reinforced, Europe Left Behind

The global stablecoin market is overwhelmingly dollarized — 99% of supply is USD-backed. Euro-denominated stablecoins barely reach €350M in market cap.

ECB advisor Jürgen Schaaf warned that Europe risks ceding monetary sovereignty if it fails to scale euro-stablecoins or roll out its digital euro quickly. Stablecoin dollarization could:

- Undermine the ECB’s control over euro liquidity.

- Raise financing costs for European governments.

- Expand US influence through sanctions and digital financial infrastructure.

“Without a strategic response, Europe’s monetary sovereignty could erode,” Schaaf cautioned.

Europe’s dilemma: sovereignty at stake

For Europe, the stablecoin boom is both a warning and an opportunity. With nearly 99% of stablecoin supply denominated in US dollars, the euro risks being sidelined in the next phase of digital finance. The ECB and EU policymakers are weighing several options:

- Support euro-denominated stablecoins that meet high regulatory standards. Backing private EUR-tokens could serve market demand while reinforcing the euro’s international role.

- Accelerate the digital euro project, giving consumers and merchants a central bank-backed digital payment option as a defense against dollar stablecoin dominance.

- Adopt distributed ledger technology (DLT) in wholesale finance, via initiatives like Pontes and Appia, to keep European capital markets competitive in tokenized settlement.

- Push for global coordination on stablecoin regulation. Without harmonized rules, US dollar dominance will deepen, leaving Europe vulnerable to financial instability and higher borrowing costs.

As ECB advisor Jürgen Schaaf recently warned, “A strategic blind spot in this space could prove costly. The euro must not be relegated to second-class digital money.”

The Risks Beneath the Boom

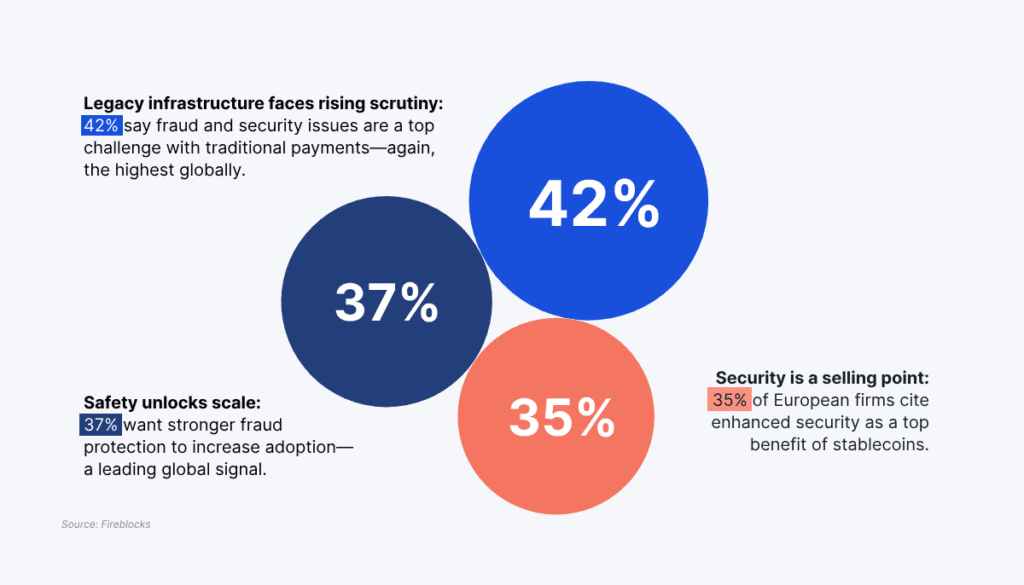

Despite the optimism, regulators and economists warn of hazards:

- Banking disruption: Funds flowing into stablecoins may drain deposits from traditional banks, reducing loan supply and credit availability.

- Financial stability: A loss of confidence in a stablecoin peg could spark a crypto-wide selloff, spilling into Treasury markets.

- Redistribution, not net demand: UBS economist Paul Donovan argues stablecoins don’t truly add demand for Treasuries — they just recycle existing buyers. “Someone selling T-bills to buy stablecoins, which reinvest in T-bills, doesn’t change net demand.”

- Speculative risk: Some stablecoins offer yield-like returns via lending and “DeFi farming,” raising parallels to money market funds with embedded fragility.

The Bank for International Settlements (BIS) has already flagged that $3.5B inflows into stablecoins lower 3-month T-bill yields by ~2–2.5 basis points within 10 days, signaling their growing influence on short-term rates.

What’s Next

The stablecoin boom intersects with major macro trends:

- Tariff-driven inflation under President Trump, pressuring Fed policy.

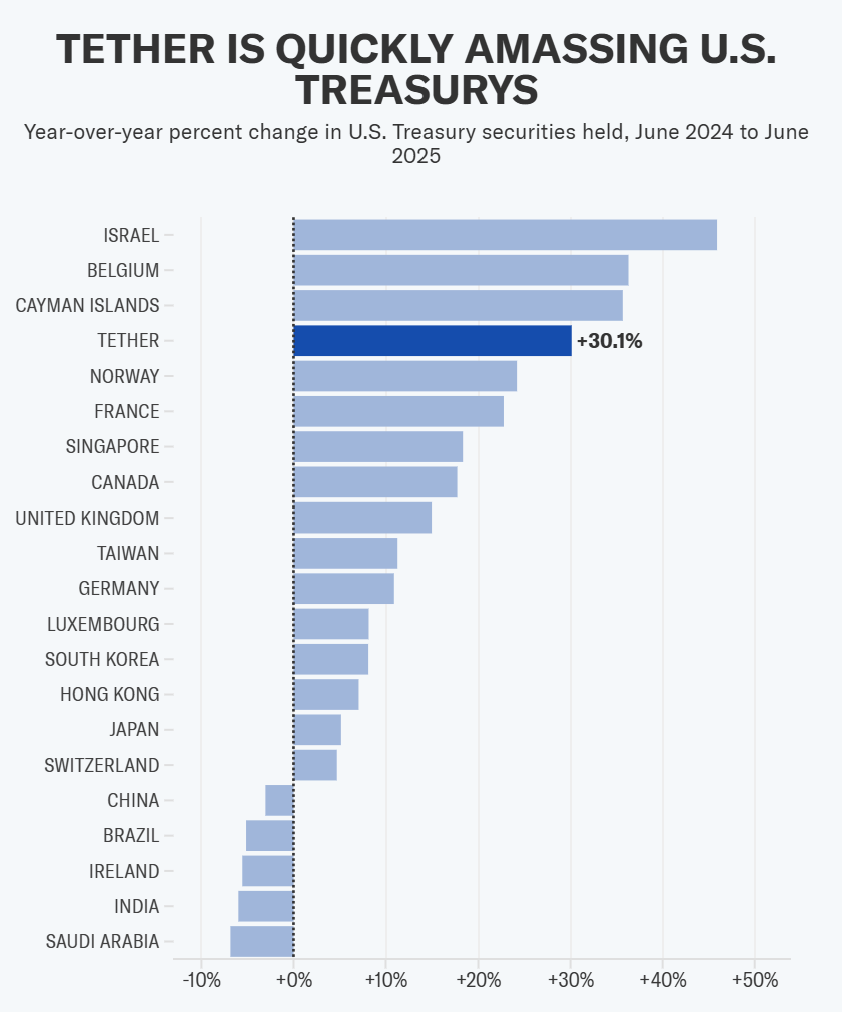

- Falling foreign Treasury demand, with China and Japan scaling back holdings.

- Fed’s shrinking balance sheet as quantitative easing winds down.

In the US: all eyes on GENIUS Act rulemaking and how issuers like Tether adapt to stricter monthly disclosures.

In Europe: the digital euro timeline will signal whether Brussels can counterbalance dollar tokens.

In Asia: China’s yuan-linked pilots may test whether stablecoins can support Beijing’s global ambitions — though capital controls remain a major constraint.

This creates a perfect opening for stablecoins to become a new anchor buyer of US debt.

Still, the geopolitical risks loom large. Emerging markets adopting stablecoins for savings could destabilize local banking systems. A US-dollar-dominated digital finance system would entrench American power but widen global divides.

Stablecoins are no longer a side story in crypto. They are becoming a central pillar of global finance, with the potential to reshape the $27 trillion US Treasury market, reinforce dollar dominance, and challenge banking systems worldwide.

Whether this becomes the “gold rush” Wall Street envisions or a systemic hazard central bankers fear will depend on regulation, adoption, and the resilience of the dollar-backed promise behind every digital token

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana