The US government has entered its longest shutdown in history, with federal agencies still closed since October 1, but Wall Street appears mostly unfazed. While political gridlock in Washington has halted key data releases, furloughed millions, and rattled sentiment, analysts say the economic impact is likely short-lived.

According to a new report by Edward Jones strategist Angelo Kourkafas, shutdowns typically shave 0.1–0.2% off quarterly GDP growth per week, but the losses tend to rebound quickly once operations resume. The 2018 record shutdown, for example, cut output temporarily — but markets recovered within months.

Short-term pain, long-term resilience

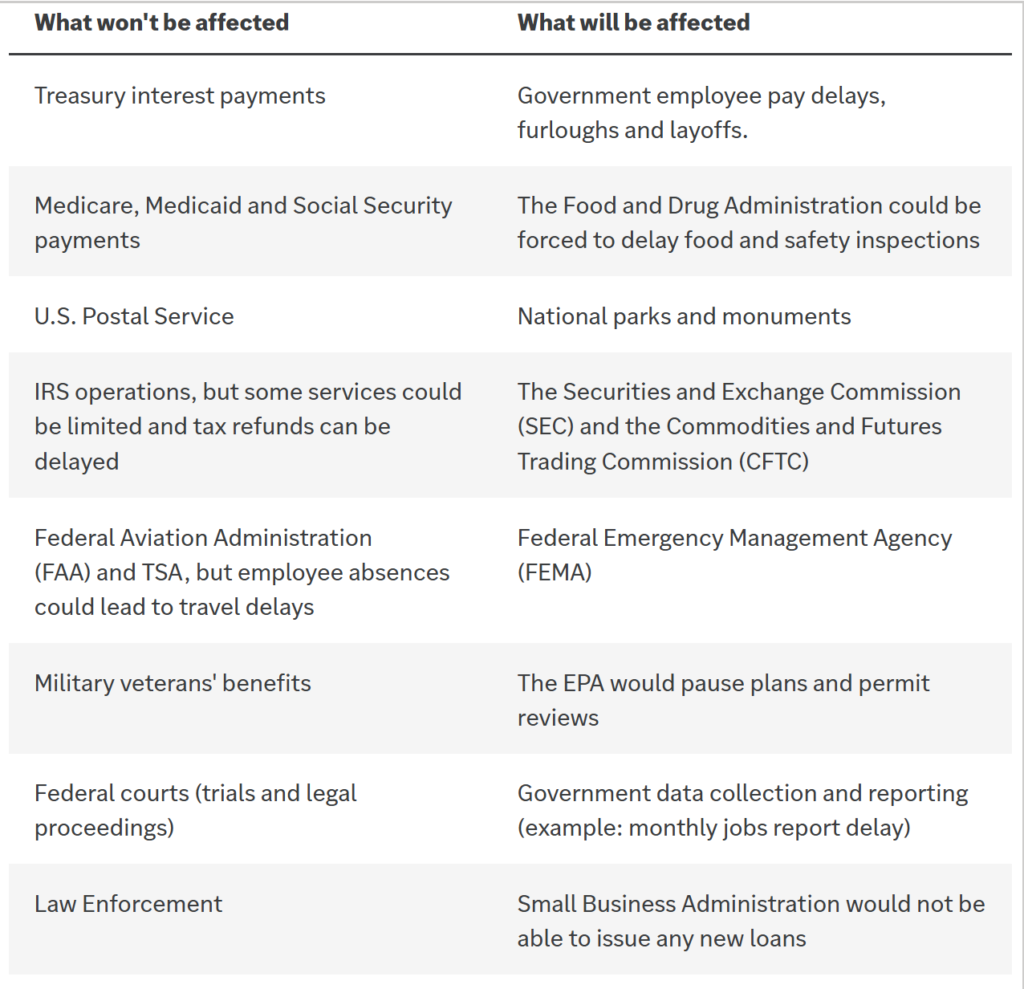

The current shutdown began after Congress failed to pass a stopgap funding bill, with disputes over healthcare and tax provisions stalling negotiations. Essential payments like Social Security and Treasury interest continue uninterrupted, but millions of federal employees remain unpaid, and data collection at agencies like the Bureau of Labor Statistics has stopped — delaying reports such as jobs, CPI, and GDP.

Markets have been more volatile in recent weeks, with the Nasdaq 100 heading for its worst week since April as investors lack fresh macro data to guide trading decisions. However, Kourkafas noted that stocks were positive in 70% of cases six months after past shutdowns, citing history as a guide for patience rather than panic.

Why Wall Street is staying calm

“Shutdowns don’t affect the government’s ability to service debt or pay bondholders,” the report said. “The disruptions are temporary, not systemic.” Analysts argue the $30 trillion US economy is large enough to absorb short-term fiscal noise, especially with the Federal Reserve already easing policy and corporate earnings holding up.

Edward Jones expects the S&P 500 to remain resilient into year-end, supported by rising profits and lower rates. While shutdown headlines may trigger brief volatility spikes, most strategists still see them as buying opportunities, particularly in US large-cap AI-linked stocks and cyclical sectors poised for recovery once fiscal operations normalize.

History shows markets can handle political theatre. For now, the bigger risk isn’t the shutdown itself — it’s the fog it creates for policymakers flying without economic data.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: BofA’s Hartnett Says Gold and China Stocks Are the Best Hedges Against the AI Boom