- GM Q4 revenue hit $47.7 billion, exceeding estimates.

- Adjusted EPS came in at $1.92, beating expectations.

- Full-year 2024 profit: $14.9 billion in adjusted EBIT.

- 2025 profit forecast: $13.7 billion to $15.7 billion.

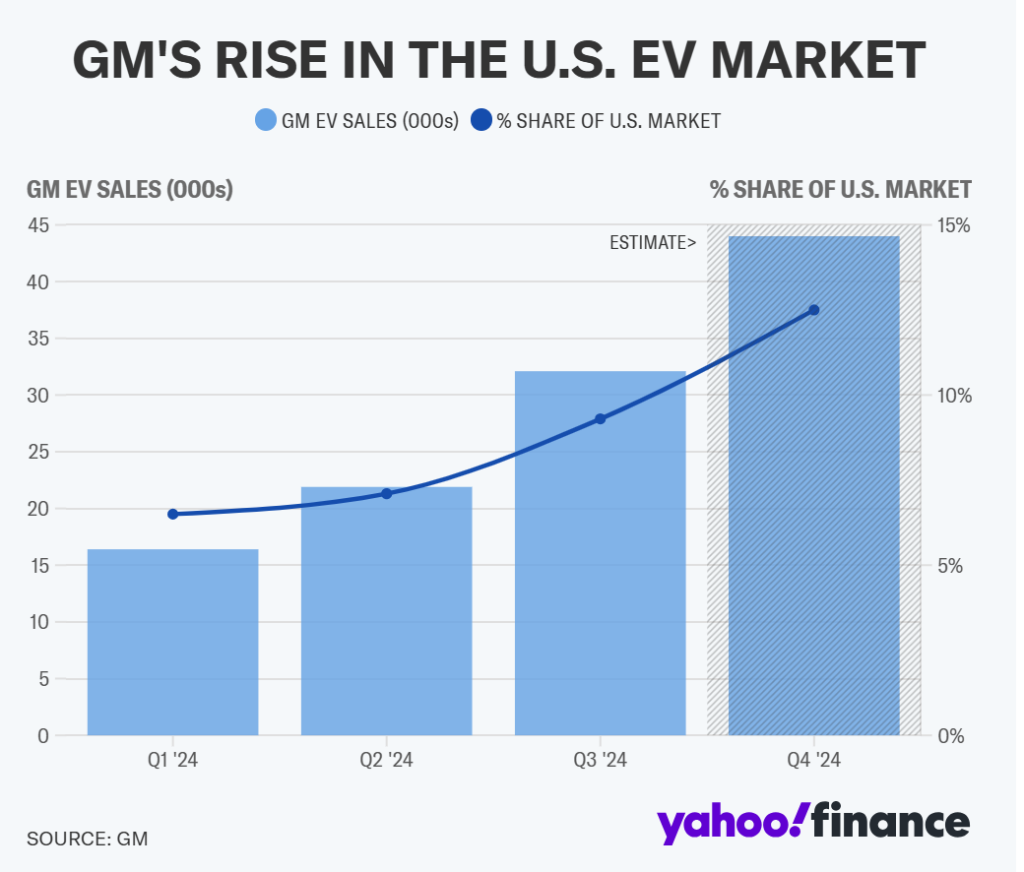

- EV market share doubled, but 2024 sales fell short of targets.

- Potential headwinds include tariffs, EV tax credit rollbacks, and pricing declines.

GM Delivers Strong Q4 Results with Positive 2025 Outlook

General Motors (NYSE: GM) closed 2024 on a high note, reporting better-than-expected Q4 earnings as the automaker continued to improve its electric vehicle (EV) business and China operations.

The company posted $47.7 billion in revenue, an 11% increase from the same quarter last year and above Bloomberg’s estimate of $44.46 billion. GM’s adjusted earnings per share (EPS) of $1.92 beat analyst expectations of $1.83. Meanwhile, adjusted earnings before interest and taxes (EBIT) rose 42.8% year-over-year to $2.5 billion.

For full-year 2024, GM earned $14.9 billion in adjusted EBIT, at the high end of its forecasted range.

Looking ahead, GM projects 2025 profit between $13.7 billion and $15.7 billion, while adjusted EPS is expected to range from $11.00 to $12.00.

Challenges Ahead: Trump’s Tariff and EV Tax Credit Risks

GM’s 2025 guidance does not include potential policy shifts under the Trump administration, such as:

- New tariffs on imports that could raise production costs.

- Possible rollback of federal EV tax credits, which could slow demand.

While GM CEO Mary Barra believes Trump understands the economic impact of tariffs, she acknowledged that losing the EV tax credit could shrink the market. However, she also argued that GM’s EV lineup remains competitive, potentially allowing the company to capture a larger share of a smaller market.

EV Growth Gains Momentum but Falls Short of Projections

GM doubled its EV market share in 2024, achieving variable profit positivity in the fourth quarter. However, the company missed its sales target, wholesaling 189,000 EVs for the year, short of its 200,000-unit goal.

Looking forward, GM expects to sell 300,000 EVs in 2025, which could boost earnings by $2 billion to $4 billion.

Key EV Highlights:

- Cadillac Lyriq and Chevy Equinox EV sales performed well.

- Full-size pickup and SUV sales surged, with the Tahoe, Suburban, and Yukon leading the segment for the 50th straight year.

- GM aims to cut EV production costs by $2 billion to $4 billion in 2025.

Stock Performance and Shareholder Returns

Despite the positive earnings, GM’s stock dropped 8.89%, closing at $50.04 as investors weighed potential policy risks.

Shareholder Initiatives:

- $6 billion share buyback program announced in June 2024.

- $10 billion accelerated share repurchase (ASR) program launched earlier in 2024.

- 33% dividend increase implemented last January.

GM CFO Paul Jacobson stated that while no new buybacks have been confirmed, the company remains committed to “prudent” capital allocation.

GM enters 2025 on solid footing, with strong earnings and improving EV profitability. However, uncertainties around Trump’s trade policies, EV tax credits, and pricing pressures could impact future performance.

The auto giant remains prepared for multiple scenarios but will need to navigate policy risks carefully to sustain momentum in a rapidly evolving market.