Circle Internet Group, the company behind the USDC stablecoin, just delivered one of its strongest quarters ever — yet the stock fell another 5%, extending a steep 40% slide over the past three months.

Here’s what’s really going on.

What Circle Does

Circle is one of the most important companies in the digital-asset world. It issues USDC, the world’s second-largest USD-backed stablecoin, used for everything from crypto trading to cross-border payments and DeFi transactions.

Circle makes money mainly through:

- Reserve income — earning yield from the U.S. Treasuries and cash reserves backing USDC.

- Transaction and platform fees — through its Circle Payments Network and blockchain integrations.

- Enterprise services — including custody, tokenization tools, and now its new Arc blockchain, built for regulated on-chain finance.

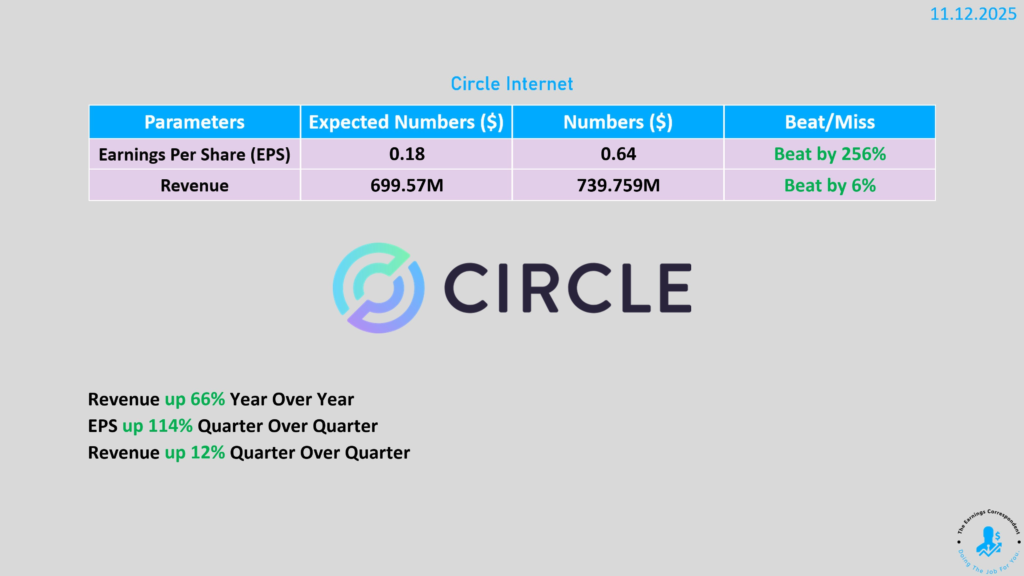

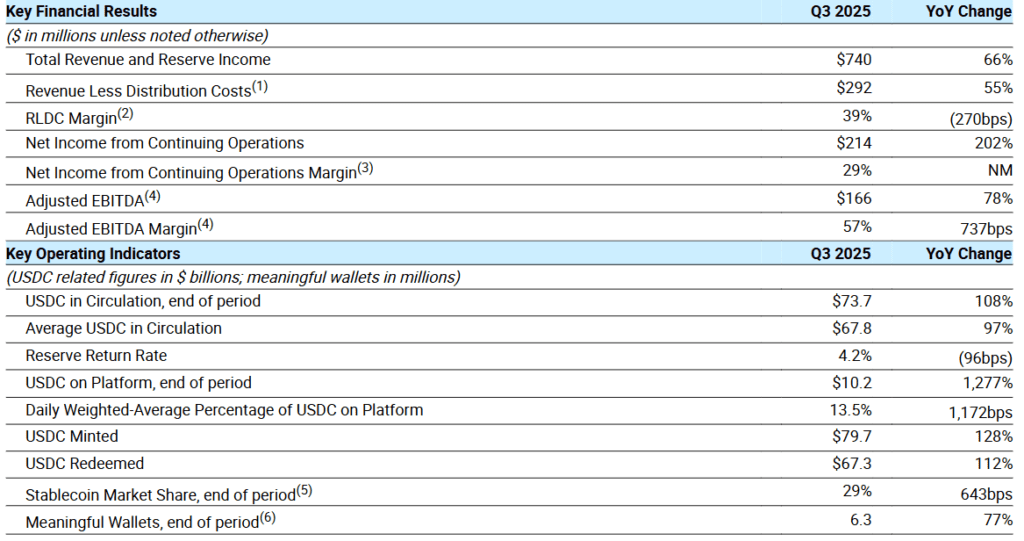

Q3 2025 Earnings Snapshot

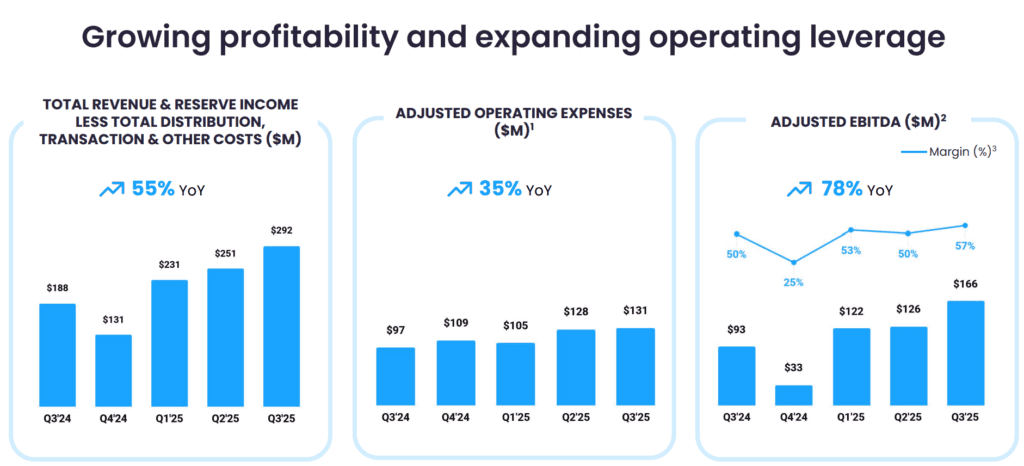

Circle’s numbers were much stronger than expected:

Circle Q3 2025 Earnings Presentation

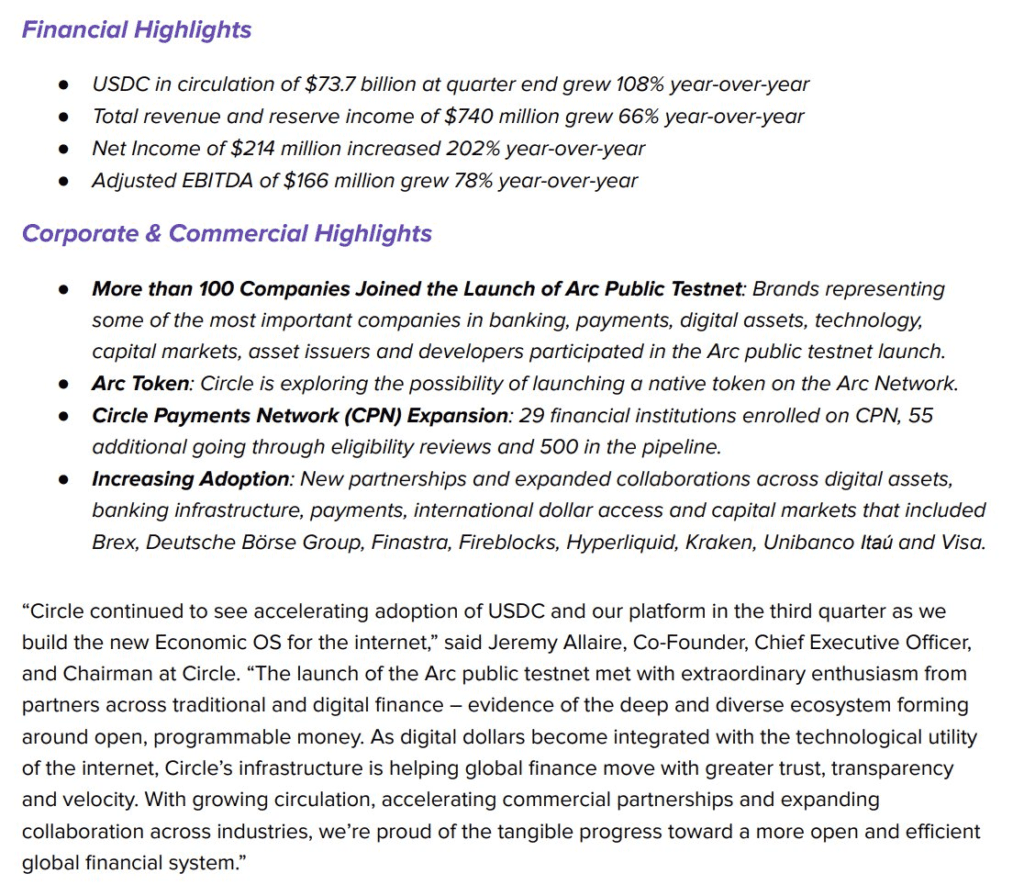

CEO Jeremy Allaire summed it up:

“Circle continued to see accelerating adoption of USDC and our platform in the third quarter as we build the new economic OS for the internet.”

Corporate and Commercial Updates:

Arc public testnet launched with 100+ participating companies

Exploring a native token on the Arc network

Circle Payments Network: 29 financial institutions enrolled, 55 in eligibility review, 500 in pipeline

New and expanded partnerships across Brex, Deutsche Börse Group, Finastra, Fireblocks, Hyperliquid, Kraken, Unibanco Itaú and Visa

Why the Stock Still Fell

Despite the big beat, investors sold off the stock, mainly for three reasons:

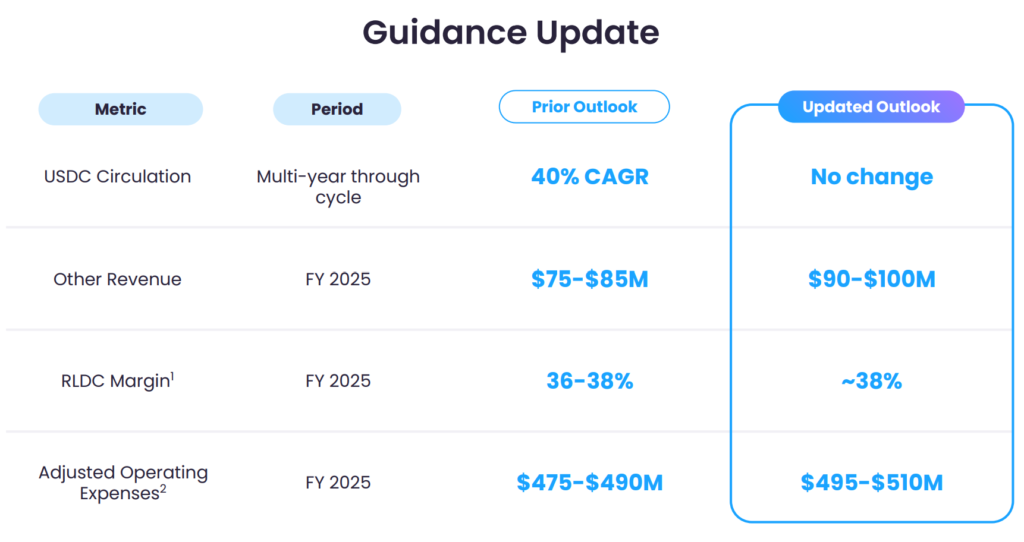

- Rising Costs: Circle raised its 2025 operating expense guidance to $495M–$510M (up from $475M–$490M).

Spending is rising as it invests in new products, hiring, and compliance, including the Arc blockchain. - Falling Yields Ahead: Most of Circle’s income still comes from interest on USDC reserves, but with rate cuts expected in 2026, that profit source may shrink. Analysts warn that “Circle will need to diversify faster to offset the impact of lower reserve yields.”

- Recent Price Pressure: The stock is down about 40% in the last three months, and traders appear cautious toward anything tied to crypto, even the more regulated players.

- The run‐up to the IPO and earlier spikes mean expectations were high; investors may be taking profits or re-assessing valuations.

Product & Expansion Updates

Arc Blockchain (Public Testnet): Circle’s Layer-1 blockchain for on-chain finance went live in testnet mode with 100+ partners, including major fintechs and institutions.

It aims to power “programmable capital markets” with sub-second transaction speed and predictable, dollar-based fees.

A native Arc token is also being explored.

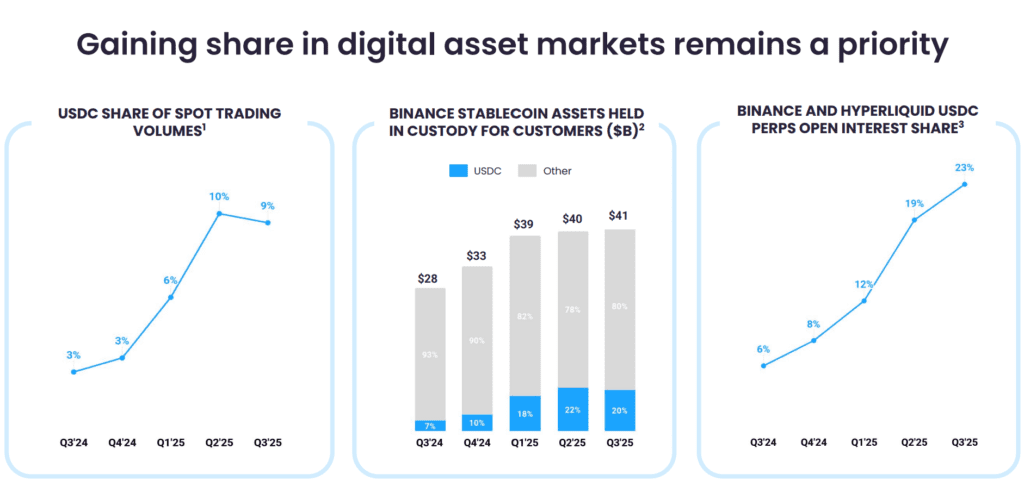

Circle Payments Network: Now includes 29 financial institutions already enrolled and 500 more in the pipeline. Partners include Visa, Kraken, Fireblocks, Deutsche Börse, and Finastra.

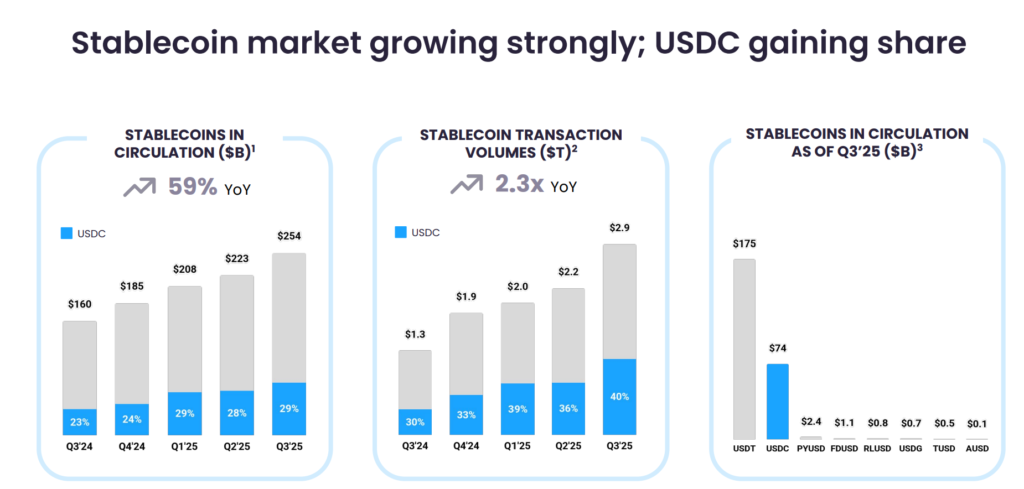

USDC Metrics

- Circulation: $73.7B, up 108% YoY

- On-chain transaction volume: $9.6 trillion, up 680% YoY

- USDC minted: $79.7B

- USDC redeemed: $67.3B

- Platform-held USDC: $10.2B, up 1,277% YoY

Regulatory Tailwind: The GENIUS Act

The Trump administration’s GENIUS Act, passed earlier this year, gave legal status to USD-backed stablecoins.

This framework boosted confidence in Circle and USDC, helping USDC supply double in 2025 to $73.7B.

Analysts say the company is “best positioned to benefit from a compliance-first stablecoin market.”

Key risks & competition

Interest rates / reserve yield: Since much of Circle’s income comes from investing reserves, falling yields hurt earnings.

Regulatory risk: Although the “GENIUS Act” and stablecoin regulation are moving, the sector remains subject to evolving rules around payments, banking, and digital currency.

Competition: Other stablecoin issuers (like Tether Limited) and new tokenised money market funds could eat into market share or margins.

- Tether (USDT) – still dominates global stablecoin volume.

- Coinbase – its close partner, co-issuing USDC in some markets.

- Strategy (MSTR) and IREN Ltd. – taking advantage of the crypto bull cycle in other corners of the market.

- New blockchain networks like PayPal’s PYUSD and traditional banks are exploring tokenised deposits.

Valuation risk: With USDC growth baked in, investors are looking for proof of monetisation (services, payments fees) beyond just top‐line growth.

Macro / crypto headwinds: Investor sentiment in crypto can swing fast; if the digital asset market cools, flows into stablecoins could slow.

Analyst View & Valuation

According to Bernstein, Circle is one of the three best-positioned US crypto firms alongside Coinbase (COIN) and Robinhood (HOOD).

They see Circle as the “most strategically positioned player in tokenized payments,” citing its: Regulated structure, Deep liquidity, Integration across 28 blockchains, $2.7T annual transaction volume.

Bernstein’s analysts set a price target of $230, implying 134% upside from current levels.

So, Circle’s Q3 beat was impressive, strong USDC adoption, rising revenues, and clear leadership in the regulated stablecoin space. But short-term pressures like higher costs, lower yields, and general market fatigue toward crypto have weighed on sentiment.

Still, if USDC keeps growing and Arc succeeds in becoming the backbone for on-chain finance, Circle could emerge as one of the biggest long-term winners of the next crypto cycle.

Current takeaway: Fundamentals are strong, the price just hasn’t caught up yet.

My take

If I were summarising: Circle is a high-growth, high-potential company in a frontier sector (digital money). The Q3 beat is encouraging. But this isn’t a safe “buy and forget” type of stock; it has execution, macro, and valuation risks baked in.

If you’re considering a position:

- Make sure you’re comfortable with volatility and the horizon (likely 3-5 years or more to truly scale).

- Watch the next few quarters for services revenue growth, fee monetisation, and margin improvement.

- Keep an eye on macroeconomic and interest-rate developments, as well as regulatory developments. these are big levers.

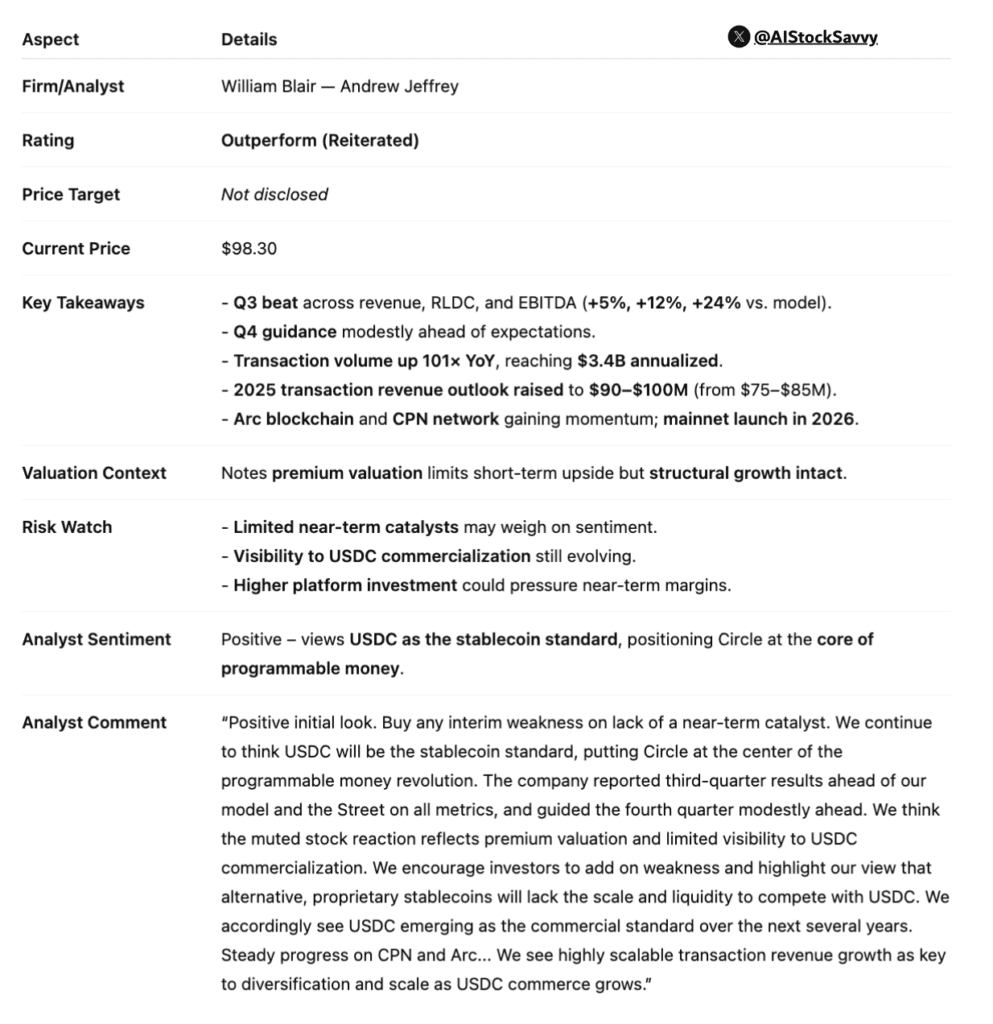

Note: Analyst William Blair reiterates 𝐎𝐮𝐭𝐩𝐞𝐫𝐟𝐨𝐫𝐦, sees 𝐔𝐒𝐃𝐂 𝐚𝐬 𝐬𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐬𝐭𝐚𝐧𝐝𝐚𝐫𝐝 𝐚𝐦𝐢𝐝 𝐬𝐭𝐫𝐨𝐧𝐠 𝐫𝐞𝐬𝐮𝐥𝐭𝐬. Analyst urges investors to buy on weakness, citing USDC dominance, strong Q3 beat, and scalable transaction growth via CPN and Arc.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:What to Watch This Week: Shutdown Deal Lifts Markets