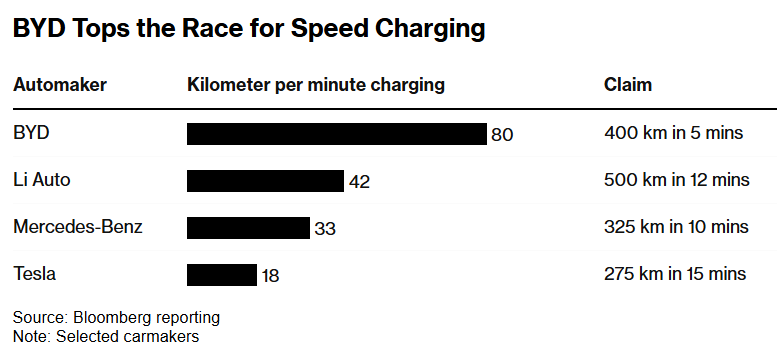

Chinese electric vehicle (EV) giant BYD ($BYDDF / 002594.SZ) has unveiled a revolutionary megawatt supercharging system, claiming it can recharge EVs as quickly as refuelling a traditional gas car. The company announced plans to roll out over 4,000 charging stations across China, sparking a new phase in the ultra-fast charging race among global and Chinese automakers.

Why This Matters:

Fast-charging technology is critical in alleviating one of the biggest concerns among potential EV buyers: range anxiety. Rapid charging allows for longer road trips without the long wait times associated with conventional charging, and it’s becoming a key selling point in China’s hyper-competitive EV market.

BYD’s New “Super e-Platform” Explained:

- Peak Charging Power: 1,000 kilowatts (kW)

- Range Boost: 400 km (249 miles) on a 5-minute charge

- Key Innovations:

- 10C batteries, capable of charging at 10 times their capacity per hour

- High-power motors

- High-volt silicon carbide power chips

- 1,000 kW chargers

For comparison, Tesla ($TSLA) currently offers 250 kW fast chargers on its 400-volt system, with Cybertruck and Semi models reaching up to 350 kW and 1,000 volts, respectively. Chinese competitors like Zeekr ($ZK), Li Auto ($LI), and Xpeng ($XPEV) have launched 800-volt platforms, achieving 400+ km of range in 10 minutes of charging.

BYD’s Charging Network Ambitions:

BYD, which commands over a third of China’s EV market, has mostly relied on third-party charging infrastructure until now. The company’s Super e-Platform requires dedicated fast chargers, and BYD has announced plans to construct over 4,000 charging stations across China. BYD’s founder Wang Chuanfu has invited external investors to help expand the network.

Still, BYD faces stiff competition:

- NIO ($NIO): Nearly 2,700 fast charging stations, plus a robust battery-swapping network.

- Tesla: Over 2,000 Supercharger stations and 11,500 Superchargers in China.

- Li Auto and Zeekr are rapidly expanding; Li Auto has built 1,900 stations since April 2023.

- Huawei ($HWT.UL): Deployed 50,000 charging piles, including liquid-cooled chargers supporting 600 kW and 1,000-volt architectures.

Challenges on the Horizon:

Despite the excitement, analysts warn that mass adoption of megawatt fast charging could strain China’s power grid, requiring substantial infrastructure upgrades. BYD aims to address this by equipping each fast charger with an energy storage unit, but this will increase costs and complicate deployment.

Bottom Line:

BYD’s move into the super-fast charging arena signals China’s intensifying EV battle, where charging speed and infrastructure are emerging as critical differentiators. As BYD ramps up, expect competitors like Tesla, NIO, and Huawei to accelerate their own networks and technology.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Warren Buffett’s Berkshire Has Been Selling US Stocks. Where It’s Buying Now

Will Trump Use the Federal Reserve as Leverage in Global Finance?

Key Events and Earning Calendar to Watch This Week (17-21 March)

Facebook’s secrets, by the insider Zuckerberg tried to silence

Quantum computing leader reveals historic breakthrough

Russia Turns to Cryptocurrencies to Bypass Sanctions and Sustain Oil Trade

Bitcoin panic selling costs new investors $100M in 6 weeks — Research

Oracle: How Project Stargate and OCI will fuel growth

Why China Isn’t Worried About Trump’s New Trade War Like It Was in 2018

Geopolitical gamble: Global Investors Make a Risky Bet on Russia’s Return to Markets