Advanced Micro Devices (NASDAQ: AMD), a pillar of the global semiconductor race, is set to report Q1 2025 earnings on May 6 after the bell. Coming off a red-hot 2024, AMD heads into this report under intense Wall Street scrutiny, with investors looking for concrete evidence that its AI and data centre bets are paying off.

l analysed 18+ reports and expert insights to bring you the most comprehensive breakdown — whether you’re an investor, trader, or beginner.

What Wall Street Expects

- Revenue: ~$5.5–$5.6 billion

→ vs. $5.35 billion last year (+4–5% YoY)

→ Slight sequential pickup from Q4’s $6.17B (which included seasonal console strength) - EPS (Adjusted): ~$0.61–$0.62

→ vs. $0.60 last year (+2–3% YoY) - Gross Margins: ~52–53%

→ vs. ~50% YoY; improvement driven by mix shift toward data center, AI chips - Segment Focus:

→ Data Center: +80–90% YoY

→ Client (PC): -20–25% YoY (PC recovery slow)

→ Gaming: Flat to slight decline (console cycles)

→ Embedded: ~Flat or slight contraction

Key Drivers Behind This Quarter

✅ Data Center Explosion: The AI Gold Rush: Across nearly every report (Nasdaq, Yahoo Finance, IG, Zacks, Barchart), analysts highlight AMD’s data center business as the core catalyst.

- Demand for MI300X AI accelerators and EPYC Genoa CPUs is red-hot, with hyperscalers like Microsoft Azure, Meta, and Oracle ramping adoption.

- Alphastreet reports AMD’s data center revenue surged ~80% YoY in Q4, and Q1 is expected to carry that momentum.

- Wall Street Horizon notes that while Nvidia remains the top AI GPU player, AMD is gaining share, particularly in “open AI” and cost-sensitive workloads.

✅ Client (PC) Market: Stabilizing, But Still Dragging

- The PC market is showing signs of bottoming, but AMD’s client revenue will likely decline ~20–25% YoY, per Zacks and Yahoo Finance.

- However, the launch of Ryzen 8000 series APUs has been well-received by OEMs, setting up a stronger 2H recovery.

✅ Gaming: Steady, Not Spectacular

- Gaming revenue (console chips for Sony PS5, Xbox Series X) is expected to be flat to slightly down YoY as the console cycle matures.

- Yahoo Finance reports that GPU refresh cycles and potential new gaming handhelds could lift the second half, but Q1 is likely to be soft.

✅ Embedded and Custom: Cooling After Pandemic Boom

- Embedded revenues (Xilinx, Pensando) are expected to moderate after two years of supercycle growth.

- IG.com and Alphastreet highlight that this segment may weigh slightly on Q1 margins.

Bullish Arguments

1️⃣ Data Center and AI Firepower: Nasdaq and Barchart highlight that AMD’s MI300X is gaining momentum, winning designs at Supermicro, HPE, and Dell. Analysts expect data center revenue to potentially double YoY in 2025.

2️⃣ Gross Margin Recovery: Yahoo Finance and Zacks point out gross margins are recovering toward 52–53%, up from 50% last year, as the product mix shifts to high-margin AI/data center chips.

3️⃣ Strong Backlog and Orders

IG.com reports that AMD has already secured $3–4 billion in AI chip backlog for 2025–26, giving visibility that few semi companies enjoy.

4️⃣ Competitive Positioning: While Nvidia leads AI GPUs, AMD is a top challenger in CPUs (vs. Intel) and is now making inroads into GPU compute, cloud, and supercomputing markets.

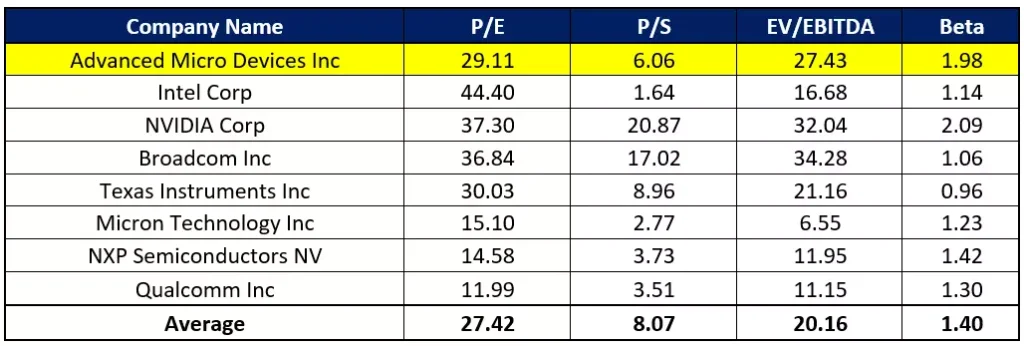

5️⃣ Stock Setup and Valuation: Yahoo Finance notes AMD trades at ~36x forward EPS — expensive, but justified if 2025 delivers 20–25% revenue growth. For long-term holders, pullbacks have historically been buying opportunities.

Bearish Arguments

1️⃣ AI Revenue Still Small Base: Despite the buzz, AI currently contributes only ~10–15% of total revenue, per Alphastreet. A slower ramp or supply issues could disappoint.

2️⃣ PC Market Weakness: The PC market’s sluggishness, with revenue down ~20–25%, is a significant drag. Zacks warns that channel inventory digestion may take until mid-2025.

3️⃣ Gross Margin Risks from Price Wars: Nvidia, Intel, and Arm-based players are increasingly aggressive. MarketBeat highlights AMD may need to cut prices on CPUs and GPUs to defend share, crimping margins.

4️⃣ China Geopolitical Risk: With ~20% of AMD’s sales tied to China (especially PCs), geopolitical tensions and export controls (reported by CNN Markets) remain a lurking overhang.

5️⃣ Stock Valuation Stretched: Morningstar and Yahoo Finance caution that at 36x forward EPS, AMD is priced for perfection. Any slip in guidance or demand could trigger a swift correction.

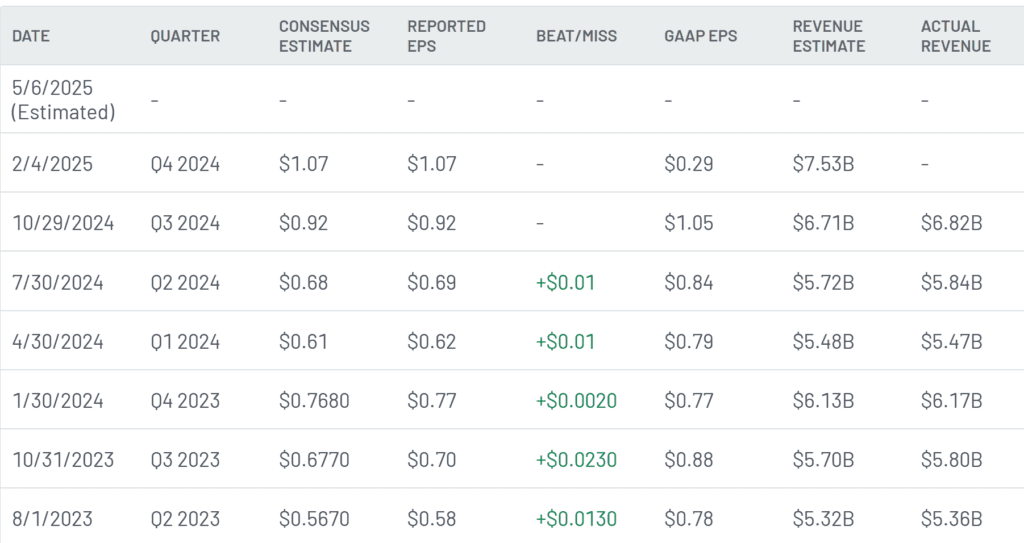

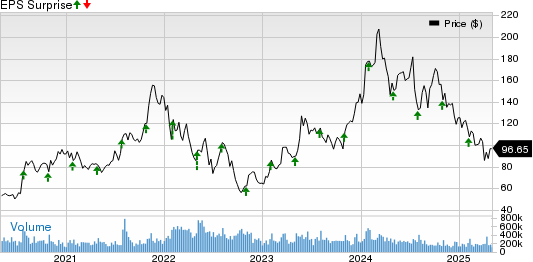

Historical Performance and Surprise History

- AMD has beaten EPS estimates in 11 of the last 12 quarters, per Zacks and MarketBeat.

- The average EPS surprise over the last 4 quarters was +6–10%, showing consistent execution.

- AMD shares typically show volatile post-earnings moves, often swinging 5–10% depending on guidance.

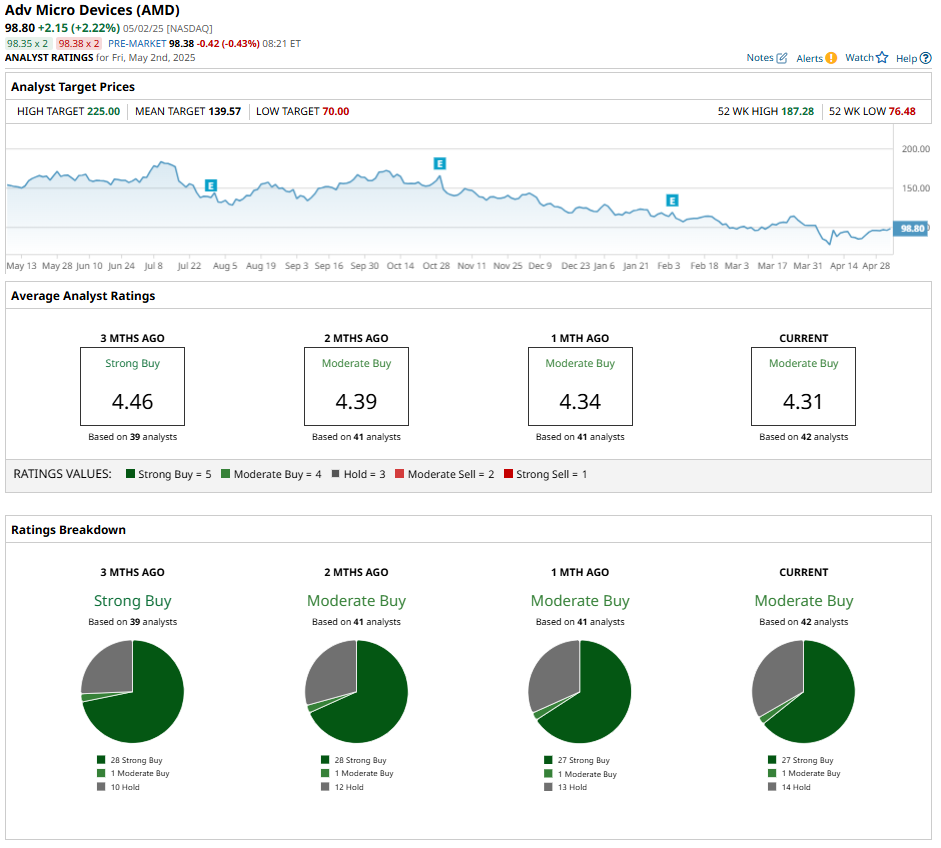

Prediction and Street Sentiment

- Revenue beat: Likely, driven by data center strength.

- EPS beat: Modest beat (~$0.63 vs. $0.61–0.62 estimate).

- Key metric to watch: Data center revenue; if it hits or exceeds ~80–90% YoY growth, the stock likely rallies.

- Stock reaction: Historically volatile → expect ±6–10% move post-earnings.

- AMD beat the Zacks Consensus Estimate for earnings in all the trailing four quarters, the average surprise being 2.32%.

Valuation, Ratings, and Market Setup

- YTD stock performance: +27%

- Market cap: ~$265 billion

- Forward P/E: ~36x

- Wall Street ratings: 28 Buy, 12 Hold, 3 Sell (Wall Street is leaning toward cautious optimism. Analysts have given AMD stock a “Moderate Buy” consensus rating)

- Average price target: ~$190 vs. ~$175 current (per MarketWatch, Nasdaq)

Final Takeaways

For long-term investors: AMD’s AI and data center business is reshaping the company, but valuation leaves little room for error.

For traders: Expect sharp post-earnings swings. Focus on data center numbers and gross margin trends.

For beginners: AMD is a leader in chips, but understand that semiconductors are cyclical, competitive, and volatile.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Palantir Q1 2025 Earnings Preview and Prediction: What to Expect

Hims & Hers Health Q1 2025 Earnings Preview and Prediction: What to Expect

Sources Integrated (some of them)

✅ Yahoo Finance

✅ The Globe and Mail

✅ Nasdaq

✅ IG.com

✅ Zacks

✅ Alphastreet

✅ CNN Markets

✅ MarketWatch

✅ Moomoo

✅ Barchart