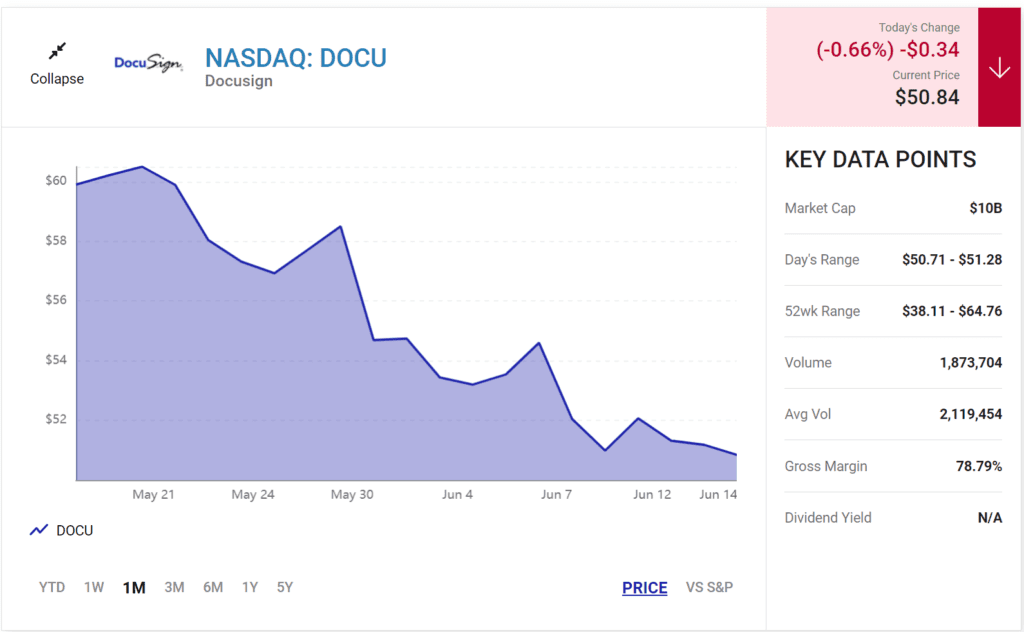

- Docusign was a pandemic darling thanks to its digital document technology that helped keep contracts in motion during lockdowns.

- Docusign has since experienced a slowdown in its business, and its stock has fallen 83% from its all-time high.

- The shares now look cheap, especially on the back of the company’s new platform, growing profitability, and stock buyback program.

Docusign (DOCU -0.66%) is quietly making a strong case for its stock as it pivots towards a more sustainable and profitable future. The company, which soared during the COVID-19 pandemic due to its cloud-based document technology, saw its stock hit an all-time high of $310 in mid-2021. However, the post-pandemic slowdown led to reduced revenue growth and necessitated cost-cutting measures.

Key Developments:

- New AI Platform: In April, Docusign launched Intelligent Agreement Management (IAM), a new platform leveraging artificial intelligence to autonomously extract and analyze valuable data from contracts. This initiative could unlock significant economic value and streamline the sales process by consolidating all of Docusign’s tools into a single platform.

- Profitability Milestone: Docusign has achieved consistent profitability, reporting a net income of $73.9 million in fiscal 2024 and $33.7 million in the first quarter of fiscal 2025. However, this profitability came at the cost of reduced sales and marketing expenses, impacting revenue growth.

- Slowing Growth: Despite the profitability, revenue growth has slowed, with a 9.8% increase in fiscal 2024 and just 7% in the first quarter of fiscal 2025. The company’s guidance suggests a modest 4.5% revenue increase for the full year.

- Valuation: Docusign’s stock trades at a near-record low price-to-sales (P/S) ratio of 3.7. Additionally, its price-to-earnings (P/E) ratio is 16.5, significantly lower than the Nasdaq-100 technology index and the S&P 500 index.

Outlook: Docusign is well-positioned for future growth, supported by its strong cash reserves of $1.1 billion and a debt-free balance sheet. The company has also initiated a stock repurchase program, spending $145.5 million in fiscal 2024 and $149 million in the first quarter of fiscal 2025. An additional $1 billion has been allocated for further buybacks.

With a profitable business model, a substantial addressable market, and the launch of its AI-driven platform IAM, Docusign appears to be undervalued. The combination of these factors presents a compelling investment opportunity with the potential for significant long-term returns.